![]()

ONLINE

![]()

ONLINE

The Bear Stearns Culture

EDITORS’ NOTE

James Cayne is Chairman and Chief Executive Officer of Bear Stearns Companies Inc., one of the world’s leading investment banking and securities trading firms. He is also a member of the executive committee that monitors and allocates the firm’s financial resources. Cayne joined Bear Stearns in 1969 as a private client salesman. In 1977, during New York City’s financial crisis, he spearheaded the firm’s efforts to help New York City avoid bankruptcy by making a market in the city’s bonds. He was named President of the company in 1985, assumed the additional post of Chief Executive Officer in 1993, and was named Chairman of the Board in June 2001. During his tenure as Chief Executive Officer, Bear Stearns has grown dramatically in terms of size, capital, and geographic reach. Cayne has guided the development of Bear Stearns’ international businesses, extending the firm’s domestic financial expertise and distribution power to the economies and financial markets of Europe, Latin America, and Asia. He attended Purdue University and holds honorary PhDs from both St. Mary’s College and St. John’s University. He is also an acknowledged world-class bridge player, having won 12 United States National Championships.

COMPANY BRIEF

Founded in 1923, Bear Stearns Companies Inc. (NYSE: BSC; www.bearstearns.com) is a leading financial services firm serving governments, corporations, institutions, and individuals worldwide. The company’s core business lines include institutional equities, fixed income, investment banking, global clearing services, asset management, and private client services. Headquartered in New York, the company has approximately 14,000 employees worldwide.

Bear Stearns has been a leader in the financial sector for many years. What differentiates the firm from its competitors and how do you define what makes the brand unique?

There is one distinguishing factor that truly sets Bear Stearns apart: Our culture, based on the principles of respect, integrity, innovation, meritocracy, and philanthropy. We have the strength and sophistication to compete on a global scale with anyone in the industry yet, culturally, we have kept the client at the center of our focus and can provide them with a personal experience. Also, these guiding principles provide a template for how our employees around the world conduct business. When you have a true meritocracy, where people are rewarded for their contributions, you develop a close-knit organization that is like having a family business without the family.

As part of your strategic plan for the firm, you look at your businesses in three core areas: Capital Markets, Wealth Management, and Global Clearing Services. Would you highlight each of these areas and your outlook for the business in each of these segments?

As I look across our different businesses and analyze our opportunities for growth, there is a lot to be excited about. We have been a leader in many areas – fixed income, equity trading and research, prime brokerage, risk arbitrage – and we continue to take steps and make meaningful adjustments to ensure that we remain at the top of those businesses. We are also embarking on many new business initiatives, including the expansion of Bear Energy, our international operations, and our new alliance with CITIC Securities. Our firm has an 84-year track record of navigating difficult financial markets. We have the agility to make the changes necessary to adapt to the next market cycle. There are situations embedded in every crisis, and we will seek out those opportunities and dedicate the best minds at the firm to understanding the options for us, and how best to capture the benefit presented. Our history speaks of success and a proven ability to adjust the business model to suit the ever changing needs of our clients. Our history also speaks of constant innovation and a commitment to serving our clients well in every market environment.

How is Bear Stearns positioning itself to handle volatility in the financial markets?

While the fixed income sector has been hampered, it is not going away. People still need to buy houses, mortgage companies still need capital, and there will always be interested parties looking to these markets for compelling investments. The market will change and new products and services will emerge. We believe that we have the ability and the expertise to capitalize on changing client needs.

With regard to volatility, let me take a moment to talk about Bear Stearns’ approach to risk management. We have made changes in our risk structure at Bear Stearns Asset Management but Bear Stearns’ fundamental approach to risk management has not changed. We have always approached the markets prudently and we continue to do so. We try to limit our exposure as best as we can, find the most effective hedging strategies we can employ, and position ourselves to operate in any market environment. When there are unprecedented market disruptions, it is easy to point out the causes – hindsight is 20/20.

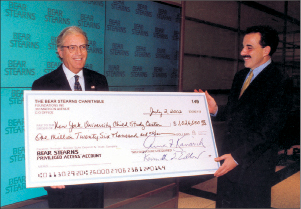

James Cayne presents a donation of over $1 million to the

New York Universty Child Study Center

Bear Stearns operates with a strong presence around the world. What markets present the greatest opportunities for the firm?

Our strategic plan internationally will continue to focus on Europe and Asia. Over the past several years, I have been impressed with what our team has achieved and we are poised to do even more. In London – where we are slated to move into a new headquarters building in 2009 – our growth has centered on translating our market-leading expertise in derivatives and structured products for European markets. In addition, we have leveraged our successful sales and trading models in equities, prime brokerage, and fixed income to serve more clients comprehensively. To keep close to our clients and to provide even better service, we have opened new offices in Paris and Frankfurt, and will look to where it makes sense to open more offices as we pursue growth across the continent. In Asia, we are extremely excited about our partnership with CITIC Securities and, as you can imagine, our offices in Hong Kong, Tokyo, and Singapore continue to grow.

Across all industries, certain markets are mentioned for future growth, with China being the leader. Would you highlight Bear Stearns’ business in China?

We have seen tremendous opportunity in China for a long time and began more than a decade ago to build relationships with key businesspeople. It is well known that I have a passion for bridge and it is a passion shared by many of the leaders in China.

With CITIC Securities, we have developed a completely compatible three-part alliance consisting of an agreement to develop new business in mainland China, a joint venture in Hong Kong, and a cross-investment. This is a groundbreaking transaction that will allow us to share expertise and allow our clients access to Eastern markets as CITIC Securities provides its clients with unique access to the West. This arrangement has paired us with one of the leading financial organizations in China and gives us an excellent foothold in one of the world’s fastest-growing economies.

How focused are you on India?

With any new foray into any new market, we look to enter prudently with a core focus on profitability. India, like China, is a dynamic place to be right now. It is a compelling market with a great deal of potential for growth. We have a license and I’d call our operations there nascent. We are pulling together our business case and evaluating the right opportunities in that market. The operations are not as developed as they are in the rest of Asia, but there is more ahead for us.

Bear Stearns is known for its talent and human capital. What is it about the culture of the firm that has made it so effective at attracting and retaining top talent?

The answer is quite simple: We give people the opportunity to make a difference early on in their careers and we recognize them for their success. Mix in the fact that we have a very collegial atmosphere that still maintains a lot of our old partnership culture, and you have a pretty compelling place to build your career. I’ve heard talk of an open door policy. I don’t have a policy; I just leave the door open.

How much of a focus is diversity in the workforce at Bear Stearns and how has this focus contributed to your success?

I think a diverse workforce is a major key to success for any firm. You need diverse ideas and talents to spur growth. That is why we have nurtured the practice of being a meritocracy. In creating a culture based on meritocracy, it helps to foster an atmosphere that puts everyone on a level playing field. You get no extra advantage because of race, religion, family background, etc. We look at what you accomplish and how you have helped others excel. It is all pretty straightforward.

Many companies today highlight social responsibility and community involvement, but this has been a part of the culture at Bear Stearns from its beginning. What responsibility do today’s business leaders and companies have to the community and how critical to the culture of Bear Stearns is giving back?

You cannot mandate a spirit of philanthropy; either people get it or they don’t. What we have at Bear Stearns is as close as it gets to an academy for future philanthropists. Giving back is such a major part of the culture at Bear Stearns that philanthropy is one of our five guiding principles. Every one of the firm’s more than 900 senior managing directors is required to donate at least 4 percent of his annual compensation to the charity of his choice. Although we require the leaders of the firm to give, what we have really created is a culture of giving within the firm at all levels. When you give a substantial amount of money to charity, you care where it goes and how it is used. When others at the firm are involved, you want to support and encourage them. While the firm also makes contributions to various important causes, for many reasons, I believe that the giving that is done by our employees has the most impact on making our communities better places to live and work. In developing our employees as well-rounded individuals and not just workers, this policy is the best thing that has ever happened to the firm. I daresay many employees will say it is one of the best things that ever happened to them.

There have been many executives that have had the opportunity to work closely with you for many years, and who you know well. If they were asked, without you in the room, what it was like to work for James Cayne, what do you think they would say?

Well, I would like to think they would say that I listen. My style is to seek diverse opinion and to build consensus for the firm’s decisions and direction. I am there to break any deadlock and I would never support an action that I felt was not right for the firm, even if my opinion seemed to be in the minority. Beyond that, you should ask them.

After all these years you seem to have the same passion and excitement for the business as in the early days. Do you really enjoy the business as much as it seems?

If anything, I enjoy it more. The firm is healthy and growing, populated with talented, deeply committed individuals, in a marketplace that is dynamic and vibrant. Every day is a new challenge. It is not always fun, but it is immensely rewarding. People ask if I’d ever think about retiring to take it easy. For me, there is little division between work and play. I saw a comment I liked from a Zen master on the art of living. It goes something like, a well-rounded professional is an individual who simply pursues a personal vision of excellence in whatever he or she does, leaving others to decide if he or she is working or playing. To himself or herself, that person is always doing both. For me, during all of my waking hours, no matter what I’m doing, the 14,000 people who work at Bear Stearns are always on my mind.