![]()

ONLINE

It’s Not the Old New York Stock Exchange

Editors’ Note

Prior to assuming his current position, Duncan Niederauer was the head of U.S. cash equities for NYSE Euronext. Before joining the exchange in April 2007, he was Managing Director and Cohead of the Equities Division Execution Services for Goldman Sachs Group. Niederauer earned an MBA from Emory University and a BA from Colgate University, where he currently serves on the board of trustees.

Company Brief

NYSE Euronext (www.nyse.com) operates the world’s leading and most liquid exchange group. Its family of exchanges, located in six countries, includes the New York Stock Exchange, the world’s largest cash equities market; Euronext, the eurozone’s largest cash equities market; Liffe, Europe’s leading derivatives exchange by value of trading; and NYSE Arca Options, one of the fastest growing U.S. options trading platforms. NYSE Euronext offers a diverse array of financial products and services for issuers, investors, and financial institutions in cash equities, options and derivatives, exchange-traded funds, bonds, market data, and commercial technology solutions. NYSE Euronext’s nearly 4,000 listed companies represent a combined $27.3 / €17.3 trillion in total global market capitalization (as of March 31, 2008 ), more than four times that of any other exchange group.

Are you pleased with the way the NYSE Euronext brand has evolved? How will the exchange look in the future?

We have the good fortune to be blessed with one of the greatest brands of all time; there are not many brands like NYSE. With the NYSE Euronext brand, we now have an opportunity to convey, just in our name, that it’s not the old New York Stock Exchange. We want to make sure we don’t dilute the NYSE brand equity, but we need to convey to the world that we’re a global company, and we mean to have a multiproduct footprint. In terms of extending the brand in Asia, for starters, it’s about being a business partner and a technology partner, because there’s not an obvious way to extend the brand through an acquisition or a merger the way we were able to do in Europe.

Is China the main market for you in Asia, or do you see strong opportunities throughout the continent?

For now, we see strong opportunities throughout Asia. Everyone is focused on China, but a lot of people are paying attention to India, and you have a very mature market in Japan. So we see opportunities of different magnitudes in all those regions. In India, for example, we’ve already been able to make investments in the leading equities exchange and the leading commodities exchange, and we’re also in discussions about being a technology partner there. We’ve had a working relationship with Japan for over a year now. My predecessor and the former Tokyo Stock Exchange [TSE] CEO signed a working agreement between the two companies, and we just announced this week that we’re going to be partners in developing a single stock options exchange in Japan. It’s also about being a technology provider to smaller markets in the region, developing commercial relationships, and seeing where it evolves from there.

While I think China is going to be a huge opportunity, it also has a much longer tail on it. You won’t see us, or anyone else, owning a piece of the Shanghai Stock Exchange anytime soon. I’ve been to China twice since I became CEO. We were the first exchange that the government awarded representative office status to, and we have opened an office in Beijing. One of the things I talked to the China Securities Regulatory Commission [CSRC] about was how companies in the U.S. can go about listing in Shanghai. We’d like to be the first company that actually does it. The CSRC and NYSE Euronext have been talking about their ambition and, if it is going to get more global, we should be the first one to go through the process, because then we can show other companies the way. Our goal is to put together a joint working group, through which we’ll spend the next few months exploring how it would work – not just to get it done for us, but also to create a blueprint for other non-Chinese companies to find their way to Shanghai. These decisions are also co-branding decisions. If you list here, it’s a lot more than just saying you list on the New York Stock Exchange or on Euronext. It struck both us and the CSRC that this was a worthwhile thing to explore. So we’re excited about the prospects.

With regard to other markets, is Russia a focus for you?

I recently traveled to the Ukraine and to Russia where I met with government officials and exchange officials. My main targets on that trip were listed companies and prospect companies. If you ask professionals in the industry there where they would think about listing a Ukrainian or Russian company, if they were to take it public, they would say London. And we aim to change that. If listing is really a co-branding decision, there’s no better group to make that co-branding decision with than NYSE Euronext.

Looking a few years down the road, do you expect further consolidation in the trading industry? Will there only be a handful of global players, and will you need to have a global reach and technological expertise to survive?

That’s our view. Others may not agree with us, but we think within five to seven years, you’ll have four to six global exchange groups with absolutely global geographic footprints and multi-asset class product footprints. There’s no other foreseeable outcome, and the only way you can survive is to be prepared to diversify that way. A big part of that is all the technology that goes into networking all of these exchanges together.

Technology has had quite an impact in the way you’re operating today. How far is it going to go? Can it replace the human part of this business?

An all-electronic, all–the-time market is certainly easier to maintain; it costs less to run. So in a market like the one we have here, we don’t spend time overprotecting the human part of it. We provide a model that provides our customers with choice, and high-tech, high-touch. Also, when you end up with these four or six exchange groups, you end up with companies that won’t look like financial services companies at that point. We will end up being more of a technology solutions provider and a technology service company in five to seven years.

If there are only four to six exchange groups with those capabilities, how challenging will it be to differentiate?

The more market structure goes electronic, the more homogenous it gets. So it will come down to the service element, as well as the brand. Also, if you look at how the world is set up now, the U.S. landscape is extremely competitive. Europe is modestly competitive with more competition on the horizon. In the rest of the world, there is only a single place to trade in most of these markets. So even though you end up with four or six global exchange groups, I’m not sure all four or six of those groups will be in Japan, China, Malaysia, or Russia. I think the groups will divide up the products and the regions. So it might not be as competitive as your normal global service industry would be.

And would it really be a full multiproduct marketplace?

If you think about it now, we already are. We have an options business, a futures business, a cash equities business in Europe and the U.S., a big exchange-traded fund business, a big listings business, and a big data business, and we’re a technology provider in all regions of the world. So we’re already pretty diversified and in a lot of asset classes. Right now, our fixed income business is fledgling. I’m sure it will be quite a bit larger, particularly when you see what has gone on in the credit space. It’s inevitable that exchanges are going to be asked to play a role in credit derivatives. So I think it will be incumbent on all of these global consolidators to be global and multiproduct in their scope. That’s going to be a requirement to be a leader in the business.

You touched on the strength of the brand. But is there awareness of how broad the platform is today, and how it has evolved in so many different areas?

The honest answer to that is no. Everyone knows our name – and that’s great – and if you ask people what they think of it, they would say it’s a high-integrity brand and a standard bearer for capitalism and free markets, and it’s a place where well-established companies list, not where emerging companies list. But they would say it doesn’t have a lot of different products and that it’s not that global. None of those things are true anymore. We are very global, we are a great place for emerging companies to list, as our umbrella has expanded, and we’re not just in one or two products. So part of what we have to do is continue to get that message out.

The public’s confidence in the markets has been shaken. Are we on the right track to build that confidence back up, and do you feel that enough is being done to address some of those issues?

We’re doing everything we can, and the U.S. Treasury has done a terrific job outlining the blueprint and talking about possibilities. Our view is, if you want to regain that confidence, the regulators, government officials, exchanges, and market-making liquidity providers are going to have to sit down together and come up with a solution that will resonate with the investing community. The unregulated part of our markets dwarfs the regulated part of our markets right now. And what we have learned is that regulated transparent markets work.

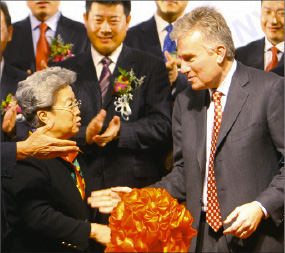

Duncan Niederaurer at the opening of NYSE’s China offices

Are young and talented people still coming into the industry? Are they aware of the career opportunities the exchanges can provide?

The turmoil in a lot of the firms that would, for the time being, be competing with us for talent – at least on the business leadership side – is an unexpected boon to us. We’re evolving to become a technology solutions and service company, and we have this great brand name. But if you went to universities and tried to interview all the students who wanted to work for a high-tech dynamic global company, I don’t think we’d be on most kids’ short list of companies they’d want to work for. So part of our job is to figure out how we can become an employer of choice for younger people, who almost view us with too much reverence. That reverence comes from our 200-year history and the impression that we are almost prehistoric. It’s hard for many people to imagine that it’s an innovative company.

Young people today are also interested in joining a company that is involved in its community. The NYSE has always played a major role in that area. Is corporate social responsibility critical to the culture of the exchange?

It has to be. At NYSE Euronext, we all contribute to charities personally or are involved in nonprofits outside of work. Also, I think we’ve underestimated the relevance of the role we can play in enhancing financial literacy in the country. We are in a perfect position to be the educator, and we have to focus on those kinds of initiatives, which are just as important as running the business, if not more so. In addition, we joined the Global Business Coalition. This is an organization of 200 to 250 multinational corporations that want to be respectful of the fact that, wherever we might be headquartered, we are global companies, and our community service responsibility extends beyond just making sure we take care of good nonprofits and worthy organizations in the United States. On my next trip to China, I’ll be going to the provinces, where a lot of our companies come from, rather than the major cities. NYSE Euronext, with the NYSE Foundation, donated $500,000 to the Red Cross Society of China and the American Red Cross International Response Fund to support the relief efforts associated with the earthquake in China’s Sichuan province. I’m setting aside part of the NYSE Foundation’s budget, starting this year and going forward, to make sure we make the right contributions in Asia, Western Europe, and Eastern Europe.

You had a successful career at Goldman Sachs. When this opportunity came up, what made you feel it was the right fit? Looking back, has it been what you expected?

It took an awful lot to get me out of Goldman Sachs. I spent my adult life there, and it’s fair to say this is the only job I would have left Goldman Sachs for. It seemed like what the company was going to need was someone more like me for the next few years. When you combine your first several months as CEO with the markets we’ve had, you learn quickly. We’re doing well, and I’ve been able to attract some really great leaders to help me run this place. I underestimated what an amazing opportunity this would be.

You seem to have a calm way about you. Is that a part of your nature, or do you just hide stress well?

It has evolved over time. Fifteen years ago, I wouldn’t have been able to be like this. We take the job very seriously, and I want people to know that we’re here to work, but we’re also allowed to have fun while we do it. I’m pretty proud of the way we’re behaving as a company right now. I believe, over time, the people who are here are going to want to be here, and they’re going to want to stay here, and I think more people are going to want to come here.

Your people can reach you at any time. How challenging is it to turn off the business, and are you able to ever really get away from it?

I’m not. The employees realize that if we are a global company, I have to be on the road a lot. You don’t assign your deputy to go to Asia; you have to be there to convey the exchange’s relevance and importance. My biggest job is to make sure I set the right priorities and then articulate them to the company, so that the people in the organization can embrace that vision. The employees receive an e-mail from me once a month that reads like a blog. It usually includes highlights of the previous month, a preview of what’s coming up, a little color on some things we announced during the month, and a personal anecdote or two. The feedback I get on the letter is unbelievable, because people seem to appreciate that I take the time to do it, and they feel like they’re getting insight into why we’re doing what we’re doing.