- Home

- Media Kit

- MediaJet

- Current Issue

- Past Issues

- Ad Specs-Submission

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

- PRIVACY POLICY

- TERMS OF USE

![]()

ONLINE

![]()

ONLINE

Fascinated By

The Airlines

Editors’ Note

Frank Lorenzo is the son of Spanish immigrants who came to New York in the early 20th century speaking no English and looking for a better life. Growing up in the shadows of New York’s LaGuardia Airport, he became enamored with airlines at a young age. With some help from his parents and working as a delivery truck driver and other jobs, he put himself through Columbia College and Harvard Business School. Then, after working office jobs at TWA and Eastern Airlines, he partnered with a business school classmate to create an aviation advisory firm, eventually purchasing a small regional carrier, Texas International Airlines (TIA). With a successful bid to acquire Continental Airlines, TIA would eventually become the largest airline group in the free world. In 1990, at age 50, Lorenzo decided to move on from the hectic life of running airlines and founded Savoy Capital, Inc. to foster his investment and charitable interests.

Will you discuss your career journey?

I grew up in Rego Park, Queens, in New York City, where I watched the airplanes overhead coming and going from LaGuardia. I attended a city high school before largely putting myself through Columbia College and later Harvard Business School. In my mid-20s, after having only spent a few years working at TWA and Eastern Airlines, I launched an airline advisory business with an HBS alum. I’m told it was a leap, based on little more than bravado, yet 20 years later, we controlled the largest airline holding company in the free world.

From the beginning, we could see the airline industry was going through a liberalization, well before formal deregulation was actually legislated. One of the first deals with our little firm, Lorenzo, Carney & Co. Inc, was arranging for the acquisition of Zantop Air Transport, a supplemental carrier – the charter carriers of their time – by buyers that we brought into the picture. Our firm would go on to create an aircraft leasing company, Jet Capital Corporation, which we transitioned into an airline acquisition firm, and were successful in acquiring a modest control piece of the equity of the small and near-bankrupt Texas International Airlines, based in Houston. I became its president and chief executive officer, and after some tough days, we turned the airline around and made it a success.

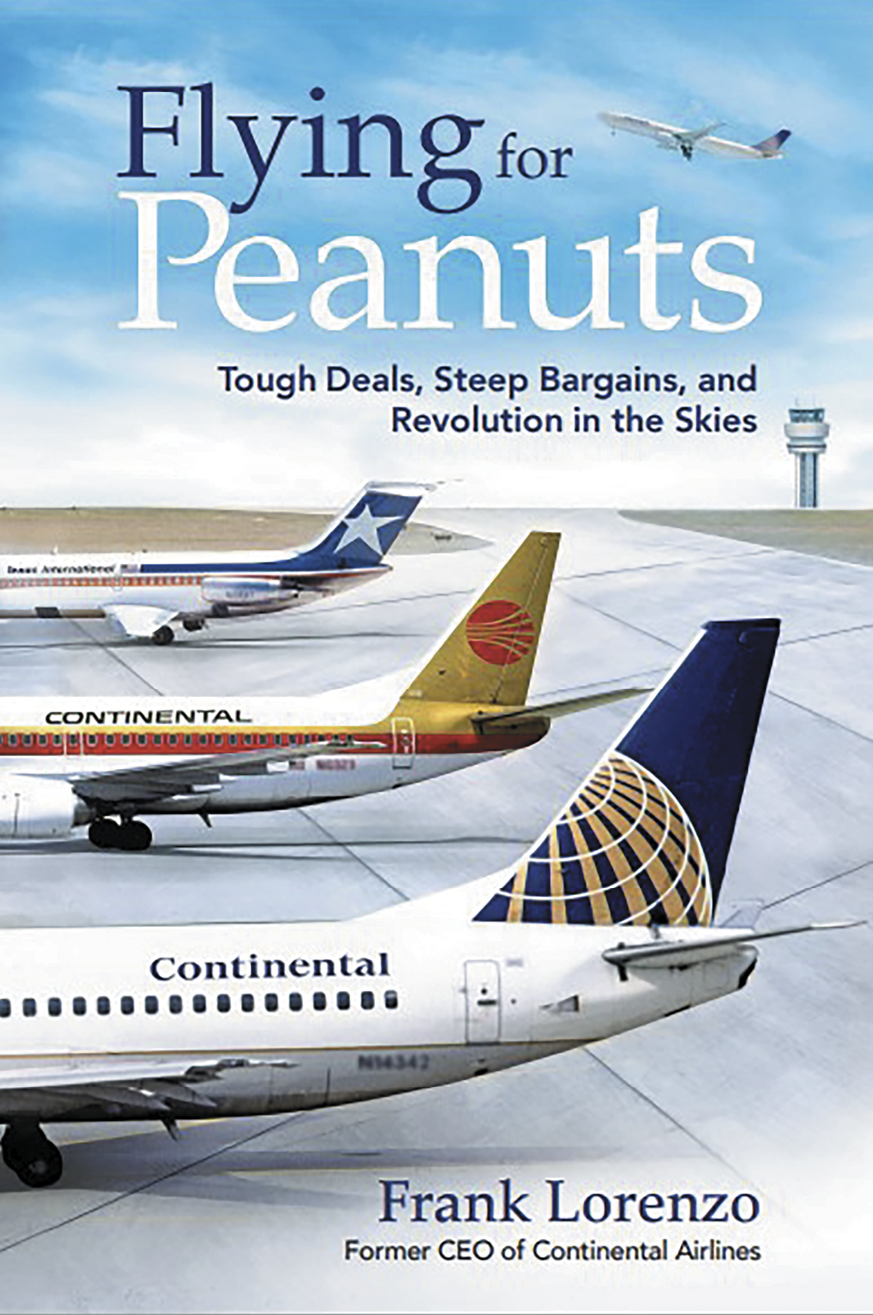

For the next 20 years, my colleagues and I built a fleet that would come to include – in addition to TIA – New York Air, Continental, Eastern Airlines, People Express, Frontier and several other small carriers. During that time, there were several significant milestones, such as TIA’s introduction of “Peanut Fares,” the first unrestricted low fares approved by the Civil Aeronautics Board (CAB) as an “experiment,” a year before deregulation was legislated. The fare program proved highly successful and provided the inspiration for the title of my book, Flying for Peanuts.

Of course, going toe-to-toe with Donald Trump during the Eastern Airlines Shuttle negotiations in the late 1980s was a memorable deal for me, given Trump’s dealmaking, the publicity and a union strike that nearly sunk it. In the end, he met our price – despite a protracted play-by-play I cover in the book – and we sold the shuttle for $365 million.

There were many successes and challenges that I experienced while managing TIA and Continental, including many of the deals that made headlines at the time, sometimes because of novel or bold moves we took, or because of labor disputes, union strikes, and other challenges. For instance, we had a difficult time on the Eastern Airlines acquisition, which ultimately proved unsuccessful because the unions bitterly fought the necessary changes to save the rapidly failing airline, leading to bankruptcy and eventual dismantling.

After more than 25 years in the airline industry, I sold our position and launched an investment management firm, Savoy Capital, in September 1990, which was always a long-term goal and operates today.

What do you feel were the keys to your business success?

Both my parents were Spanish immigrants who arrived in the United States in 1920 with nearly nothing, but both had an entrepreneurial mindset that they instilled in me and my brother from an early age. After working for years and saving their money, they opened the Larian Beauty Salon in 1937, named after their first names (Larry and Ana) and successfully ran it for 40 years.

In my career, perhaps the most basic key to my success was identifying excellent managers, bringing them in and organizing them into a team. I also found it important to develop a clear strategy and staying riveted to its execution and, hopefully, accomplishment. Importantly, I also believe that I was willing to take strategic risks, even though I knew some might not work out – and some didn’t.

In addition, and very importantly, I believe Texas was a great home for building a business and was important to us in many ways. All in Texas rose to support the effort, which probably would have been more difficult or impossible in many other states.

What do you see as the traits to effective leadership and how do you approach your management style?

An effective leader inspires a team and creates a bond among the members, as well as lays out clear, common goals. My management style depended on the circumstances. I could be a hands-on manager, often at very critical turning points, such as steering Continental through bankruptcy – the first for an airline – and the subsequent creation of the new Continental. I also could be a manager who stood back, as I often did during critical promotional moves, relying on the expertise held by the marketing stars in our ranks who I respected, and who were more sensitive to the consumer.

What made the airline industry so special for you?

I had long been fascinated by the airlines, though early on I had also considered other industries for my career. Still, as a teen, I recall following airline industry news and sending requests for annual reports from some of the commercial aviation giants. My hero in my younger days was Howard Hughes, who controlled TWA, which may have been, in part, why TWA also was my favorite airline. Another factor about airlines that has always attracted me is the opportunity set that I have felt that airlines offered. This has been punctuated by the leverage inherent in the business, both debt leverage and, even more striking, operating leverage – an additional passenger can be added, if there are empty seats, at virtually no increase in operating costs.

What interested you in writing the book, , and what made you feel it was the right timing for the book?

I started the book more than 25 years ago, but it was in fits and starts, although a lot of research was accomplished then. It wasn’t until about four years ago that I really decided to finish the book. I wanted to write a book about the difficult period of airline deregulation transition and how we had to adapt to it to succeed. Much had been written about it from the outside, but no one had written about it from the inside, having actually lived through it. I also wanted to counter the enormous PR effort of the airline unions, which made me into a monster so that they could distract the public and their members, and avoid speaking of the realities of deregulation’s impact. I wanted to help counter the anti-union and union-buster labels the unions had successfully pinned on me, with the facts of what we went through which would lead to a different view. Finally, I wasn’t getting any younger, and I needed to take advantage of the opportunity to get the book across the finish line – certainly a worthy project in my eighties.

What are the main messages you wanted to convey in the book?

We are fortunate to live in a country where entrepreneurs with limited resources can be successful. That’s something I learned from my parents and throughout my career. I thought my story would help with that message. If you follow your calling or passion, you can often be successful. Each day heading to work wouldn’t feel like work. In my case, I felt I had two passions – airlines and, in later years, investment – a calling that continues today.

What are your views on the state of the airline industry today?

Today’s airline industry is amazing, in terms of scope, safety record, and outlook. Meanwhile, research and development efforts are helping to shape the industry’s future. We see environmental efforts, such as the use of sustainable aviation fuel (SAF), as well as increased consumer convenience, such as a potential new era of supersonic travel. Too often, airlines are the favorite fall guy for the press and politicians. President Biden and Vice President Harris, for instance, has recently criticized baggage fees charged by the airlines, calling them junk fees, which sounds good but isn’t the full story. These fees are a critical part of the lower fares that exist today and are an integral part of the economic structure of airlines. When you unbundle services, you can create different fees that offer consumers choices. If someone is traveling light, they may enjoy a lower fare. If they want to bring more bags, they pay more. In many ways, it’s similar to some gym membership structures or streaming services. Pay more for your membership and you can gain access to more locations; pay less and you may have less options. Similarly, you can choose a streaming subscription with ads or without – each reflecting a different price.

Of course, some criticism of the airlines can be deserved, such as in cases of safety issues, mismanaged scheduling or other controversies. But, too often, the media and politicians are quick to criticize and develop a “whipping boy” before getting the full story.

With all of the success that you had in your career, were you able to enjoy the process and celebrate the wins?

I pride myself on looking at work as something that’s typically enjoyable, rather than a major chore. My family is also a major part of my story. My family was always a basic part of my day, as I was always home for dinner and enjoyed spending time with my family on weekends, which was made possible by not accepting the many golf, etc. invites that came from bankers, suppliers, and the like.

What advice do you offer to young people beginning their careers?

You should follow your calling, as I’ve said, if you feel you have one, and if you have the opportunity and it financially fits with your present or future needs or those of your family’s. Also, don’t expect that a diploma from an “elite” university is the ticket to a fortune. If those days ever existed, they are over. But, importantly, do get a good education, whether in a community college, vocational school or a college. And don’t be afraid of a career that requires some manual labor and doesn’t necessarily require a four-year college degree. Plumbers and electricians are some of the steadiest, well-compensated positions to have today.![]()