- Home

- Media Kit

- MediaJet

- Current Issue

- Past Issues

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

- PRIVACY POLICY

- TERMS OF USE

![]()

ONLINE

![]()

ONLINE

Defining Leadership

Editors’ Note

Since Vista’s founding, Robert Smith has supervised over 600 completed transactions, representing more than $330 billion in aggregate transaction value. Born in Denver, Colorado, Smith trained as an engineer at Cornell University, earning his BS degree in chemical engineering in 1985. After graduation, he worked at Goodyear Tire and Rubber, followed by Kraft General Foods, where he obtained two U.S. and two European patents for coffee filtration systems. Upon receiving his MBA from Columbia Business School, he joined Goldman Sachs in tech investment banking, first in New York City before moving to start Goldman’s tech practice in Silicon Valley. In 2000, Smith founded Vista Equity Partners, which has since been recognized by Private Equity International as its Global Technology Private Equity Firm of the Year. As a leading entrepreneur, philanthropist, and industry pioneer in software and technology investment, Smith has been invited to speak about finance, entrepreneurship, innovation, leadership, and related topics at a variety of venues, including the World Economic Forum Annual Meeting, the Milken Institute Global Conference and Columbia Business School events, among others. He has also appeared in numerous written publications, podcasts, television, and other media interviews. Smith is the founding director and President of Fund II Foundation, which provides grants to fund efforts that safeguard human rights, provide environmental conservation, and more. Smith also led the creation of Student Freedom Initiative, which offers freedom in professional and life choices for select STEM students attending Historically Black Colleges and Universities (HBCUs), other Minority Serving Institutions (MSIs) and Tribal Colleges and Universities (TCUs). Smith also co-leads Southern Communities Initiative, a consortium of companies with a single mission: to accelerate wealth creation and economic growth in six Southern U.S. communities. Smith is Chairman of Carnegie Hall and SFI. For his business acumen, Smith has been recognized as one of Forbes’ 100 Greatest Living Business Minds and TIME 100’s Most Influential People in the World.

Firm Brief

Vista Equity Partners (vistaequitypartners.com) currently manages over $100 billion in assets under management and oversees a portfolio of over 90 enterprise software, data, and technology-enabled companies that employ over 100,000 people worldwide.

Will you discuss your career journey?

I began my career at Bell Labs while I was still in high school. We were just starting to learn about early computers, and I was fascinated. I had a deep desire to learn more about them and how they worked, and one of my teachers shared that they were powered by transistors made at Bell Labs in Denver. When I found out they were made so close to me, I knew that I had to work there. The internship was only for college students, but I believed I had the knowledge and curiosity that would allow me to compete with the other interns. After I called relentlessly each Monday for five months, I was offered an interview when an MIT student did not show up – and I secured the role. That was a transformative experience. I was surrounded by mentors who gave me the freedom to explore, ask questions, and discover what I call “the joy of figuring things out.” I continued working at Bell while I pursued my bachelor’s degree from Cornell in chemical engineering. After graduating, I worked at Goodyear Tire and Rubber and then Kraft Foods, where I earned four patents (two in Europe and two in the U.S.). I later developed another invention that we did not patent, which saved Maxwell House coffee millions of dollars a year.

I started to learn the difference between labor and capital, and decided to pursue my MBA at Columbia Business School. At a Black Business Student Association event, I met John Utendahl, already an icon in the investment world. He invited me to lunch in his office and asked if I had ever considered investment banking – which I hadn’t, because at that point, I saw the profession as not creating or building anything. But it was in that meeting that I began to see investing as a way to achieve impact at scale. I got a job at Goldman Sachs, where I opened the firm’s tech investment division in San Francisco, working on mergers and acquisitions. It was at Goldman where I began to see firsthand how software would be transformative. While there, I worked on a deal for a client named Sam Zell, and after we finished the deal, he gave me one of the best pieces of advice I ever received. He told me not to be like the other guys at Goldman, that until I was independent and running my own business, I would never be free. By 2000, I decided to leave Goldman and found Vista Equity Partners to invest in and grow software companies at scale.

How do you define Vista Equity Partners’ mission?

While I was at Goldman Sachs, I worked with companies like Apple, eBay, Yahoo, and other emerging companies in the early days of tech. That experience exposed me to the promise of enterprise software to drastically improve business efficiency and profitability in a systemic, scalable way. I became determined to implement those improvements myself, rather than advising companies on someone else’s behalf. I took those lessons and my deep experience with software and created Vista, where we would invest exclusively in enterprise software, data and technology-enabled businesses. We focus on companies across maturity stages and we provide expertise, operational guidance and capital to position companies for sustainable, long-term growth.

When I left Goldman to start Vista, it really was a leap of faith. Software had not yet demonstrated the type of growth we now associate with it. There were no private equity firms at the time that exclusively invested in one industry, let alone software. But I had seen software up close and knew it would become a business tool. And over the last 25 years, we’ve developed a playbook that has driven rapid growth within our portfolio companies across market cycles and through successive waves of technological innovation. We were able to help transition companies from on-prem to cloud, and now, from cloud to AI, generative AI, and agentic AI.

“Most important, in my view, is Dr. King’s fight for economic justice. True economic equality, a central component of Dr. King’s vision, eludes us to this day. We must act to close educational gaps, improve access to quality healthcare, and expand pathways to generational wealth. It’s only by addressing these systemic issues that we can finally reach the type of society of which Dr. King dreamed.”

What have been the keys to Vista’s strength and industry leadership?

Vista’s strength comes from our discipline as investors in enterprise software. We’ve evaluated over 8,500 deals – and we’ve declined 95 percent of them. This is because we only develop investment theses around operational factors we can control, influence, and de-risk. If we do not believe that a prospective acquisition meets our criteria, we look – and wait – for other opportunities.

By partnering with executives and founders, we can accelerate the corporate maturity of their businesses by executing value-creation strategies that aim to drive revenue and deliver EBITDA growth. Our disciplined approach gives us a deep understanding of risks, enabling us to engineer solutions to overcome them and to deliver consistent, risk-adjusted returns.

Another factor contributing to our success is our exclusive focus on enterprise software since our founding, which has enabled us to become experts in this space. Over two decades, we’ve built up one of the largest teams and a repository of best practices that we disseminate throughout our portfolio to drive growth and improve efficiency. It’s a competitive advantage that allows us to scale companies quickly and create lasting value.

Another area that contributes to Vista’s success is our pricing discipline on deals, both at purchase and at sale. One example of this is how we slowed our capital deployment during the valuation bubble in 2021. Thanks to our 25-year history of operating in this space, we believed that the market valuations were untethered from historical averages, which is why we held on investing in several companies over that period as we continued to look for deals more in line with our expectations.

Finally, we have a world-class team. The data shows that diversity of viewpoints overwhelmingly boosts productivity and efficiency. That’s why we’ve implemented programs from internship and entry-level roles to the C-suite and corporate boards, to ensure we’re inclusive of a wide array of backgrounds and experiences. One such program, Girls Who Invest, aims to equip talented young women to succeed in investment management. Another program, Vista’s Frontier Fellows, provides undergraduates who demonstrate great potential to drive business value at Vista, and who have proven they exemplify characteristics of our Mission, Vision, and Values, with private equity paid internship opportunities, mentorship, and professional development. And our best practices provide guidance for our portfolio company CEOs on building inclusive teams, including an approach to effective corporate boards.

“It’s an exciting time to invest in enterprise software. We see AI as significantly enhancing the efficiencies we can unlock and expanding investment opportunities in the broader market.”

How has AI and automation influenced the way Vista operates and evaluates investment opportunities?

Enterprise software is already the most productive business investment possible, generating an average 625 percent ROI for our portfolio companies’ customers. Artificial intelligence dramatically increases this impact, and is the most promising and exciting emerging technology in a generation. According to the McKinsey Global Institute, AI is poised to add $13 trillion to the global economy by 2030. We see AI following the traditional cycle of innovation, with three distinct waves of value creation. The first wave benefits hardware vendors who will build the infrastructure to power AI. The second can benefit superscalers like Microsoft and Google that already have the ability to offer broad access to compute. The third wave can benefit enterprise software vendors who can provide AI solutions on top of existing products, which is where the most significant opportunities for substantial value creation exist.

Our portfolio companies have already been leveraging AI to drive revenue; 100 percent of our majority-owned companies are now using some form of code assist or generative AI-enabled code. Several years ago, we formed a generative AI council that includes many of our CEOs to share lessons and insights on AI integration. And, at our annual hackathons, we focus on AI, stimulating new ideas and collaboration so that we remain at the forefront of innovation.

Just as we worked with software companies in the 2010s to unlock efficiencies by migrating to the cloud, we view integrating AI, especially agentic AI, as the next frontier driving innovation, revenue, productivity, and value creation. We believe AI will feed software and continue to increase its efficiency and ROI.

In May, we launched a first-of-its-kind Agentic AI Factory aimed specifically at scaling Agentic AI across our portfolio. Our framework includes operational restructuring, agent deployment at scale and go-to-market enablement. By partnering with Microsoft to create this factory, we’re positioning our companies to integrate agents directly into hyperscaler app marketplaces. This approach builds on our pioneering and highly successful factory approach, which we previously used to convert enterprise software companies from on-prem to cloud.

It’s an exciting time to invest in enterprise software. We see AI as significantly enhancing the efficiencies we can unlock and expanding investment opportunities in the broader market.

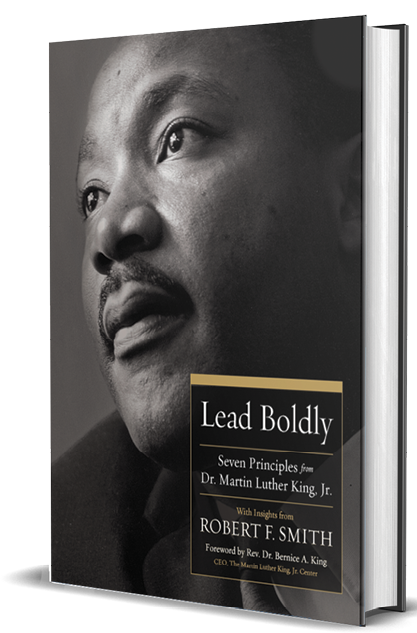

What interested you in writing your new book, Lead Boldly: Seven Principles from Dr. Martin Luther King, Jr., and what are the key messages you wanted to convey in the book?

Dr. King embodied bold and compassionate leadership. He was assassinated more than 55 years ago, but his words continue to inspire millions of people around the world. He achieved a level of influence and impact that was nearly impossible for a Black man born in Atlanta in the 1920s.

Two years ago, I was approached by my good friend, Bernice King, and the King Center, who invited me to participate in this first-of-a-kind project alongside HarperCollins. The idea was to share Dr. King’s ideas with current and future generations of leaders, particularly in business. It was incredibly humbling to be asked to contribute to this project. I knew that I had to get involved and work to make sure Dr. King’s principles and messages reached leaders who have the capacity to advance his vision today. I’ve been engaged with the King Center’s work for many years. Through Fund II Foundation, an organization I founded in 2014 to preserve the African-American experience, I purchased the birth and life homes of Dr. King in Atlanta and transferred them to the National Park Foundation for historical preservation. I also spoke and marched alongside the King family at the 60th Anniversary of the March on Washington.

The book is organized around seven of Dr. King’s speeches or writings, each highlighting a distinct theme, principle, or lesson that he preached. These include his concept of the “Beloved Community,” a society rooted in justice, equal opportunity and love for all, and being the “man or woman in the arena,” using our voices to advance our communities, and the importance of including and fostering bonds with allies in our cause.

Most important, in my view, is Dr. King’s fight for economic justice. True economic equality, a central component of Dr. King’s vision, eludes us to this day. We must act to close educational gaps, improve access to quality healthcare, and expand pathways to generational wealth. It’s only by addressing these systemic issues that we can finally reach the type of society of which Dr. King dreamed. This is good for our entire country, as McKinsey estimates that eliminating racial inequalities could increase U.S. GDP by up to $1.5 trillion.

How should today’s leaders in business consider adopting Dr. King’s leadership lessons and values in their lives to help advance racial equality and opportunity?

There are a number of active steps that leaders in the private sector can take to help us reach the promised land. Dr. King spoke of building partnerships that can scale the infrastructure necessary to create a new generation of opportunity. That journey starts from within: make a conscious effort to recruit talent from more diverse communities, including Historically Black Colleges and Universities (HBCUs) – not just for full-time roles, but also for internships. You can open the door to applicants from places that are often overlooked yet full of talented and ambitious young people looking to make a difference.

Recruitment is just the beginning. Leaders can make sure that their companies provide job training and mentorship to make sure the workplace is inclusive, encouraging everyone to achieve their full potential. They can also implement practices to support corporate board diversification, bringing fresh perspectives, flexibility and responsiveness to evolving consumer needs. At the supply chain level, leaders can diversify their vendor relationships and work to support more Black businesses, creating greater economic opportunity in underserved communities. Within their communities, leaders can partner with nonprofits doing important work on the ground, like those aiming to bridge the digital divide in Black communities. These steps can support the building blocks of systemic change beginning at the local level.

Finally, as an investor, I am incredibly focused on pension allocations and the composition of pension managers. Union workers who contribute to pensions are about one-third minorities, yet only about 1.4 percent of the people who manage their savings are minorities. This disconnect can be a driver of racial disparity, as less diverse management groups are less likely to invest in businesses owned by people of color or companies that operate in communities of color. By diversifying the industry, we can ensure that workers’ retirement funds are invested in businesses that serve their communities.

By taking these types of steps, corporate leaders can help advance racial equality at both the local level and in ways that can systemically scale, reflecting the bold leadership practiced and championed by Dr. King throughout his life.

Where did your interest and passion for philanthropy develop?

I’ve always been inspired by the example set by my mother. When I was young, she made a $25 donation to UNCF every month, no matter our family’s financial situation. She demonstrated a consistent commitment to the belief that we had a responsibility to invest in the next generation. She never saw that donation as just a gift, but rather an investment in limitless potential. That mindset shaped me early on. I came to see philanthropy as a form of community-building, a way to invest in that “beloved community,” as Dr. King called it, where we all support one another and hold ourselves accountable for each other’s progress. That vision of mutual responsibility and lifting others as we climb continues to influence my philanthropy today.

What do you feel are the keys to effective leadership, and how do you approach your management style?

Effective leadership begins by embracing principles that inspire followership. Personally, I look to Dr. King’s unique combination of relentless optimism and perseverance. Achieving true equality, realizing the dream Dr. King spoke of over 60 years ago, is difficult work. It will require that we stay focused, act with intention, and lead by example. Yes, the arc of the moral universe bends towards justice, but it only bends because we make it bend. There will be moments when we will feel disheartened, but we cannot let that change our focus on making the world a place we wish it to be.

That type of leadership is applicable across the corporate world. Effective leaders hold steady in moments of setback, refusing to lose sight of their vision and encouraging those around them to do the same. I lead with clarity and deep conviction that change – durable, lasting, systemic transformation – is possible when we pursue it together.

Leaders also listen to their employees, peers, customers and members of their community. When you hear diverse perspectives, you build a culture of trust and empower people to meaningfully contribute, ultimately building a stronger and more resilient organization.

What advice do you offer to young people beginning their careers?

Take risks. Today, especially in the Black community, we do not always encourage our young people to step out of their comfort zone. This was something I experienced with my grandfather when I decided to go back to business school. He could not understand why I was taking this risk and leaving a good-paying engineering job. He was as confused when I left Goldman Sachs and took on the risk of starting Vista. Believe in, bet on, and invest in yourself, and take the risk to pursue your passions and dreams.

The second thing I will say is that you are enough. You are enough to change the condition of your community, to take your own leap of faith and, most importantly, to take care of one another and enable the next generation to carry the baton of progress further than ever before.

What does success mean to you?

Success is as much about what you accomplish as it is about empowering others to achieve the same. Help support the young people who follow the path you paved. Collective success uplifts us all.![]()