- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

Putting an End

to Heart Disease

Editors’ Note

Dr. Clive Meanwell is the Founder and Chief Executive Officer of The Medicines Company since 1996. He was previously a partner and managing director at MPM Capital, L.P. and, before that, held positions at F. Hoffmann-La Roche, Inc., including Senior Vice President at Roche Biosciences in Palo Alto, and leadership roles at Roche’s Basel, Switzerland, headquarters. Meanwell received his M.D. cum laude and MB, ChB. from the University of Birmingham, U.K.

Company Brief

The Medicines Company (themedicinescompany.com) is a biopharmaceutical company driven by an overriding purpose – to save lives, alleviate suffering and contribute to the economics of healthcare. The Company’s goal is to create transformational solutions to address the most pressing healthcare needs facing patients, physicians and providers in cardiovascular care.

What were the reasons behind The Medicines Company shifting directions so dramatically over the past few years?

Because we have a resilient sense of purpose and discipline, we go after healthcare innovation systematically. First, we try to figure out the medical and economic need; then, the job-to-be-done. Next, we source and develop technology to deliver improvement and growth and, finally, we work hard – very hard – to drive cost-effective changes in healthcare delivery and outcomes. We’ve used this innovative process successfully for many years and it is probably the main reason we were ranked number 1 for biopharmaceutical R&D efficiency in CNBC’s RQ Rankings for 2014 and 2015.

However, our innovation engine stalled when our lead product, Angiomax®, which reduces deaths, major bleeds and costs associated with heart procedures and which was the top-selling hospital drug in the U.S. at the time, came off patent in late 2014. Our revenue – at peak over $650 million per year – dropped like a stone and our share price, which had grown five-fold in four years, declined by 50 percent. Although we had, in the meantime, won FDA approval for several new hospital products, we didn’t have the financial wherewithal to launch them strongly into major markets.

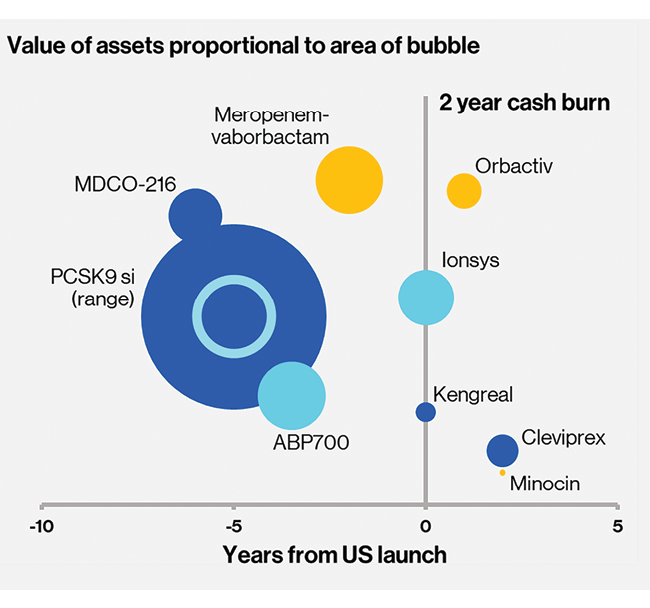

We considered a sale of the firm to big pharma, but they’re not enamored with the hospital sector. So we took a long, hard look at our portfolio and figured out that one of our earlier stage assets, a highly experimental drug for lowering bad cholesterol, code-named PCSK9si, might be our best bet. In late 2015, we announced a plan to divest non-core assets, go back to our roots in R&D and focus on that drug.

How challenging was the restructuring process?

The process was perhaps the most significant leadership challenge we’ve ever faced – certainly one of the hardest I’ve ever faced in my tenure as CEO. The rational side was fine. We did careful analyses and discussed strategy with the board. We sold off technologies and businesses in three major deals, and we restructured our balance sheet. All told, we mobilized about $1.1 billion in non-dilutive financing.

The emotional side was far more difficult. We started with about 650 committed people and ended up with fewer than 60. Fortunately, many went to jobs with the products we had sold to others. Meantime, some of our investors cashed out, and others put pressure on the board, concerned that our admittedly high-risk pirouette was too little, too late.

At this time, do you think this was the right strategic move?

Well of course only time will tell. But some things are clear. The highly experimental drug code-named PCSK9si that I spoke of – which the World Health Organization subsequently dubbed inclisiran – has turned out to be one of the most promising technologies to improve human health of the current age and thanks to our restructuring, we have the resources to complete the R&D demanded by regulators like the FDA to get the green light to market it.

What makes inclisiran so exciting?

Inclisiran has the potential to solve one of the most vexing health challenges of all time. How do you get a large population of otherwise quite well people to lower their bad cholesterol (LDL cholesterol) over the long haul? We now know that if we can do that, millions of heart attacks and strokes will be avoided and worldwide healthcare expenditures can be reduced by trillions of dollars.

What makes bad cholesterol, which many people view as just a number, such a threat?

Bad cholesterol is by far the biggest killer of humans on Earth, accounting for more than 30 percent of all deaths – mainly due to heart attacks (about 10 million) and strokes (about 7 million) – every year. The most frightening problem is that LDL cholesterol is a stealthy toxin. It’s low when we are born, but partly due to the way we live and partly because of our genes, it gets higher with age, starting in our early teens. Then the products of LDL-C start being deposited as fatty streaks that eventually become dangerous atheroma bumps lining our arteries. It happens slowly and without signals in most people. Then suddenly, at an average age of 66 for women and 70 for men, bang! The atheroma in arteries that supply the heart, brain or limbs reaches a tipping point and the patient has a heart attack, stroke or limb ischemia event. With any luck the patient gets to a hospital in time for life-saving treatment, often with Angiomax®. If they survive which, thankfully most now do, they’ll be classified as “high risk” for the rest of their lives.

Some people may have early manifestations of chest pain or a transient reversible stroke that alerts them and their doctors that trouble is brewing. Better still, though this sadly applies to only a small minority of people, they may have checked their cholesterol levels, found them high and started on lifestyle changes, or taking a statin. The sad fact is that, around the world, the first time most people know they have a problem is when that first heart attack or stroke hits them and then it’s too late.

If we’re fortunate enough to be able to provide the world with its first “flu shot” for cardiovascular disease, we will indeed have fulfilled our purpose.

How did you decide to address this challenging health problem?

We decided that we had to think about it differently from any previous approach to cardiovascular disease and explore other medical avenues.

We realized there are many diseases, some short term and some long term, but most of them infections of one kind or another, where we prevent the illness before it gets started. Remember that in the last 250 years, lifestyle changes such as clean water, improved diets and simple hygiene measures have been hugely successful. So have vaccines, first used widely in the U.S. by George Washington to stop smallpox in the army, that confer either lifelong protection as with modern vaccines for children, or a year’s worth of protection like an annual flu shot.

What, we asked, might a vaccine for cardiovascular disease look like? We decided it would have to be reliably and consistently effective at lowering LDL-C substantially – cutting it in half as statins and new drugs called PCSK9 monoclonal antibodies do, for example. In order to encourage adherence by patients, it would have to be easy to use – perhaps an infrequent shot by a health professional to make sure it’s given reliably. Because it would be given to otherwise healthy people, it has to be very safe. Finally, in a cost-constrained healthcare world, it would have to be cost-effective.

How does inclisiran meet those requirements?

This is where we get very excited. Our early research suggested inclisiran could be all of those things. We knew that blocking a protein in the blood called PCSK9 with monoclonal antibody drugs lowers LDL-C by about 50 percent on top of treatment with statins. Work by our friends and colleagues at a leading Cambridge biotech company called Alnylam, from whom we licensed the technology, showed that there is another way to reduce PCKS9 – by reducing its synthesis in the liver before it’s released into the blood. Alnylam had an experimental drug that reduced PCSK9 and LDL-C in humans with an intravenous infusion over several hours, but it wasn’t easy or convenient to use.

We licensed the technology and worked with Alnylam scientists to design and develop a better mousetrap – a drug that is equally effective but given as a small and quick shot in the abdomen or arm. In 2016-17, we showed it worked well enough and for long enough that it could be given just twice a year, or perhaps even once a year. That was a big step forward. Suddenly, we had something that looked like a vaccine.

The next phase of studies of inclisiran in about 600 patients, published in leading medical journals and featured at leading medical science meetings, showed a very promising safety profile. In 2017 we moved on to larger, late-stage clinical trials in thousands of patients. Those trials are now more than halfway through, and interim results, including more than 1,600 patient-years of treatment, indicate the safety profile of inclisiran continues to be promising. The trials will end around the third quarter of 2019.

You mentioned cost-effectiveness earlier. What is the expectation for cost and will healthcare systems around the world be able to afford inclisiran?

We’ve done a lot of work these last five years to study the extent and costs of cardiovascular disease and the potential value of preventing heart attacks and strokes for the healthcare system and for society more broadly. Our studies concur with other, independent research from places like the Harvard School of Public Health and UCLA. In a patient at high risk in the U.S. who has already had a heart attack or stroke, lowering the risk of a second event that could be fatal by 25-30 percent creates about $5,000 of value in the healthcare economy per year. If the patient is at lower risk, perhaps with high LDL-C and a family history but no previous heart attack, then the value of lowering risk is about $3,000 a year.

These numbers don’t mean much to the families who lose their loved ones, but they mean a lot to people who have to decide what to spend our healthcare dollars on. If we can manufacture and distribute inclisiran in the U.S. efficiently enough to price into these windows of value, then we have a potentially affordable and sustainable intervention that could be used widely without breaking the proverbial healthcare bank. We’re working with some of the leading manufacturers of high-tech drugs and we believe we can pull this off. It may even be possible to offer a cost-effective, affordable and sustainable intervention in other regions of the world where healthcare spending is below that of the U.S. and where prices for treatments are necessarily lower than here.

If we’re fortunate enough to be able to provide the world with its first “flu shot” for cardiovascular disease, we will indeed have fulfilled our purpose.

What makes inclisiran so different from current drugs that suppress bad cholesterol?

Our core science is RNA interference, first described by Andrew Fire and Craig Mello who won a Nobel Prize for their discovery in 2006. RNA interference is a natural phenomenon that regulates protein production. The interference occurs when a unique RNA sequence inhibits the production of a single protein by silencing the genetic message that controls the protein’s production. It’s akin to a faucet and a mop. Inclisiran shuts off the faucet that produces bad cholesterol, whereas the current drugs just mop it up after it has been produced in the liver.

Where are you in the development process for inclisiran?

If all goes according to plan, we will submit our application for new drug authorization to the FDA in late 2019 and to European regulators in early 2020. That could mean inclisiran becomes available to patients and health systems by 2021.

Are your shareholders willing to remain patient as inclisiran works its way through the testing and regulatory process?

I mentioned earlier that investors were understandably skittish as we went through our major restructuring in 2015-16. But since then the value of our firm has increased as investors have acquired shares, betting on the future of inclisiran. We believe they recognize the enormous potential global market for inclisiran. We are fortunate to have a thoroughly engaged board of directors. They realize, as I do, that we have multiple ways to realize the value of our work through strategic actions, all of which are aimed at maximizing the enormous healthcare opportunity we have before us.

For us, building sustainable, human-centric solutions is more than a slogan. We believe it is an imperative of modern healthcare. All our stakeholders come to the challenge of defeating heart disease as both professionals and as human beings.