- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

A Commitment to Values and Ethics

Editors’ note

Ratan Tata has maintained his current post since 1991. He is also Chairman of other Tata companies, including Tata Motors, Tata Steel, Tata Consultancy Services, Tata Power, Tata Tea, Tata Chemicals, Indian Hotels, and Tata Teleservices. Tata joined Tata Steel in December 1962. After serving in various other Tata companies, he was appointed Director-In-Charge of National Radio & Electronics Company Limited (NELCO) in 1971. In 1981, he was named Chairman of Tata Industries. Tata is Chairman of the Government of India’s Investment Commission and a member of the Prime Minister’s Council on Trade and Industry, the National Hydrogen Energy Board, and the National Manufacturing Competitiveness Council. He also serves on the U.K. Prime Minister’s Business Council for Britain. He is a member of the International Advisory Council of Singapore’s Economic Development Board, and of the international advisory boards of the Mitsubishi Corporation, the American International Group, JPMorgan Chase, and Rolls-Royce. He also serves on the boards of Fiat SpA and Alcoa. Tata is President of the Court of the Indian Institute of Science and Chairman of the Council of Management of the Tata Institute of Fundamental Research. He is a member of the board of trustees of Cornell University and of the University of Southern California. Additionally, he is a member of the Global Business Council on HIV/AIDS and the Program Board of the Bill & Melinda Gates Foundation’s India AIDS Initiative. Tata received a Bachelor of Science degree in architecture with structural engineering from Cornell University in 1962 and worked briefly with Jones and Emmons in Los Angeles before returning to India later that year. He completed the Advanced Management Program at Harvard Business School in 1975. He has been conferred an honorary doctorate in business administration by The Ohio State University, an honorary doctorate in technology by the Asian Institute of Technology, Bangkok, an honorary doctorate in science by the University of Warwick, and an honorary fellowship by the London School of Economics.

Company Brief

Mumbai-based Tata Group (www.tata.com) was founded as Tata Sons in 1868. Tata Sons and Tata Industries are Tata’s promoter companies, and Tata’s areas of business include information systems and communications, engineering, materials, services, energy, chemicals, and consumer products. Tata has over 90 operating companies, of which 27 are listed on the Bombay Stock Exchange; an international presence in 80 countries; and an employee base of more than 350,000.

Tata is a historic company and yet it has always found ways to stay fresh and competitive. How has the economic crisis sharpened your company’s keen sense of identifying opportunity, with respect to all of your existing companies and with respect to extending the brand with new offerings?

The economic crisis has served to re-emphasize the importance, to all Tata companies, of cash flows, cost rationalization, investor relationships, and continuous performance improvement. However, it is difficult to generalize the impact of the economic crisis across the Tata companies in terms of identifying opportunities. In recent times, Tata companies have been encouraged to grow in pursuit of strategic objectives and to eschew growth for growth’s sake. The economic crisis does not change that guideline. The crisis does, however, present an opportunity for companies which are moderately leveraged to look at cost efficient strategic acquisitions and/or market expansion. Similarly, companies which have made major acquisitions or capacity additions may need to focus on consolidation and cost control to deal with the downturn, but would still be advised to aggressively address areas of weakness in their business model such as security of raw material supplies.

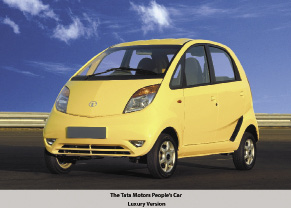

Tata companies have been encouraged for some time to introduce innovative products and services for the lower half of the social pyramid in India and similar markets. The economic crisis has, fortuitously for Tata companies, underlined the importance of affordability and value consciousness for all but the highest segment of customers worldwide. Sensing opportunity in the changed circumstances, Tata Motors has brought forward its time line for introducing the Tata Nano to markets akin to India and also to Europe and the U.S. It is an example other Tata companies with contemporary products for the lower end of the market could emulate.

What do you do to keep the entrepreneurial focus sharp in a large multinational multi-business company? How do you groom the next generation of leaders to think as entrepreneurs?

Historically, Tata has not been an “owner-managed” business. Professionals and intrapreneurs have had a key role in the evolution of many Tata companies. This legacy continues to thrive. Company CEOs have the freedom to explore and experiment with business opportunities that could drive growth, while Tata Sons, as the promoter with its framework of appropriate reviews and control, acts as a coach by challenging CEOs and business leaders to be bold and think big, and to “lead, and never follow.”

Grooming the young to become leaders has proved to be somewhat of a challenge for Tata companies. The process of grooming leaders was severely handicapped until recently because of the disinclination of our managers to move from one company to another, thus depriving themselves of valuable cross-industry knowledge and a diversity of experience. This lacuna is being addressed and inter-company movement of managers is acquiring robustness.

Further, as is not unusual in a tradition-bound group of companies, in our companies, youth was also too often equated with inexperience and age with wisdom. The prominent role of young managers in creating breakthrough products like the Ace and the Nano has held out examples to the contrary. We are now beginning to see Tata company CEOs emerge in the age group that other companies with a longer tradition of leadership planning have long had: in their late 30s and early 40s. This is an encouraging development for our large pool of young and bright managers, though we still have room for improvement in this area.

Our framework for assessing the leadership potential of tomorrow’s leaders is similar to that of other corporates except in one aspect: passion, energy, the ability to inspire, selflessness, fairness, openness, curiosity, humility, the ability to set an example, good communication skills, high emotional intelligence, and domain knowledge – we value all these attributes in our next generation of leaders, but over and above all these, we look for a proven record of commitment to values and ethics.

What do large Western-based companies and entrepreneurs need to consider before entering or doing business in emerging markets such as India?

India spells opportunity going forward due to its large population dominated by youth and the vast reservoir of unmet needs for its growing population. Within that framework, however, Western companies need only to learn from the experience of their compatriots in emerging markets like India to compile their list of dos and don’ts.

India is a value for money market, so the price point at which you enter and the degree of customization of the product or service offered could determine whether you are mining the mass market or aiming at a niche. India is also an open society and the customer is aspirational and knowledgeable, so it would be advisable to incorporate the latest technology in the products offered. Finally, doing business in India presents unique challenges, so it pays to be patient.

Tata has partnered with a variety of companies – Unisys, IBM, Mercedes-Benz India, and BP, among others. What are the most important priorities and the key characteristics you look for in a joint venture partner? Is it challenging to retain an entrepreneurial spirit within a joint venture or alliance with another large company?

The most important characteristic that we look for in a joint venture partner is a shared sense of values on how to do business. Beyond that, we look for strategic complementariness and an equal status.

Many of our joint ventures in the ’80s and ’90s were actually a form of market entry for overseas multinationals and were not necessarily premised on a long-term view of what each partner would do beyond the initial market entry stage.

In such ventures, there may not be much scope for entrepreneurial activity, but if there could be joint ventures oriented to introducing new products and services in India and elsewhere in the world, those may be more worth our while. The alliance/joint venture with Fiat is one such example. Since it is based on a broad desire to collaborate and assist each other in entering different product-market segments, it is more likely to be mutually beneficial and rewarding.

What is your outlook for opportunity for Tata to expand into emerging markets? What markets do you consider most promising? You have talked about the importance of China. Where does China fit into Tata’s future plans?

Many of our large companies like TCS, Tata Steel, Tata Tea, Tata Motors, Tata Chemicals, and Indian Hotels are already present in multiple markets, both emerging and developed. Growth decisions are located in companies and aligned to their strategic objectives so it is difficult to generalize on market expansion ambitions across different sectors. But some of the attractive growth markets that we may consider ourselves underrepresented in would be China, Brazil, and Turkey, as well as some of the Southeast Asian economies like Vietnam and Indonesia. We also think the Middle East and North Africa have potential, but individual markets in these countries are usually smaller in terms of volumes and expected turnover.

China has become India’s largest trading partner, so it is going to be an important part of Tata’s future growth plans both as a market and as a sourcing hub. Tata Sons has a representative’s office there already, and China is only the third country to have such an office, after the U.K. and the U.S. TCS, Tata Steel (through its subsidiary NatSteel), Tata Tea, and some other companies have already established a robust presence there. That said, our companies would feel even more emboldened to address opportunities in China if the business environment there were to exhibit greater clarity and consistency in regulatory issues and an enhanced degree of sanctity of contractual obligations.

As you look at the next generation of opportunity, what advice would you offer to global entrepreneurs?

The impact of climate change and the rise in inequality, which has attended globalization, are key challenges facing all of us. Entrepreneurship with a social purpose would address itself to both these challenges by zealously embracing the latest in green high technology to combat climate change and create products and services which could improve the quality of life of the large majority of the world’s disadvantaged.