- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

Editors' Note

Paul White assumed his current role in August of 2007, and was elected to the board in June 2008. He has had a 23-year career in the lodging industry, 18 of which have been at Orient-Express Hotels. He has been a hotel General Manager, a Financial Controller, and a Regional Vice President with profit and loss responsibility for the company’s operations across one third of the globe. Having previously served as Chief Financial Officer of the company, he joined it from Forte Hotels in 1991.

Company Brief

Orient-Express first came into being in 1883 as one of the world’s most indulgent train journeys. The company (www.orient-express.com) now embraces hotels, cruises, and other luxury rail adventures in 25 countries, across five continents. Orient-Express has offered exceptional luxury travel experiences since 1976, when it first purchased Hotel Cipriani in Venice and shortly thereafter, recreated the celebrated Venice Simplon-Orient-Express, linking London, Paris, and Venice, along with other European cities. Today, the company owns or part-owns and manages 50 businesses, 41 of which are highly acclaimed hotels. Additionally, there is one stand-alone restaurant, two river cruise operations, and six luxury trains.

James Sherwood, who founded the company, was very clever in getting assets like Cipriani and the trains together, and by the early ’90s, we realized that we had a leisure experience company.

I was quite involved in the acquisitions in the mid- to late-’90s. We expanded a lot into South America and into Australia, and purchased a few more properties in the U.S., including the ‘21’ Club in New York.

The Eastern & Oriental Express traveling

between Singapore and Butterworth, Malaysia

We took the company public in 2000 and continued on the acquisition trail, but still ran the company as a collection of assets. The name Orient-Express is known to investors because we’re a public company, and investors buy shares in Orient-Express – they don’t buy shares in the our individual hotels. In talking with guests, they are enthused about the properties, but when you mention Orient-Express, they get a blank look on their faces.

So, in 2007, I sat down with the management team at my first management meeting to discuss what Orient-Express is and what role Orient-Express plays within the company. We concluded that the brand was very powerful but was underutilized. We looked at changing the brand mark from a very confusing collection of letters and symbols to something that very clearly states our name. We aligned the mark very much to luxury goods marks as opposed to other hotel marks, because there is a space there not filled by any other hotel or leisure company at the very high end.

We are now concentrating on having the top hotels, leisure experiences, safaris, cruise ships, and trains in the world.

We have two cruise businesses: one is in Burma and we have a barge business in France, which has beautiful little péniche barges.

Additionally, we have sold assets this year that we consider not core to enhancing the brand, the company, and the guest experience.

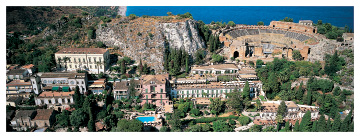

We are also looking to enhance the portfolio. In Sicily, we acquired the Grand Hotel Timeo in Taormina and the Villa Sant’Andrea in Taormina Mare.

The Grand Hotel Timeo, adjacent to a Greek theater

We have an unofficial list of 20 or 30 properties that if and when they come to market, we would be very interested in, and we have a very subtle way of letting the owners know of our interest. We try to get ourselves into a position where if they get to a point where they want to sell, that we’re the first people they come to. We’re natural acquirers of these sorts of businesses because we tend to continue to run the businesses in a similar way to how the owners ran them. What we add is financial discipline, marketing clout, filling the properties, and clever pricing decisions to get the room rates.

Yes, and we’re still involved in the project. It’s not actually over the ‘21’ Club; it’s the building behind the ‘21’ Club – the Donnell Library. The idea was to build a truly iconic hotel for New York of around 150 rooms, each over 550 square feet.

However, to build in New York is very costly, especially now. The only way the economics would work was if we were able to sell 50 percent of the building off as condominium space, but that is not an option now, so the project is on hold.

‘21’ Club wine cellar dining room

I’m not a micromanager. I like to set clear targets and I do expect people to achieve. I expect a good level of integrity and honesty out in the field, and in general, that has been repaid. But I’m not a soft person, and since I’ve taken over, we have made more changes in managers out in the field than we probably had in the past 10 to 15 years, because if you do set clear objectives of what you want, and somebody doesn’t achieve them, you have two decisions to make: either you help them to achieve it the next time or you make a decision that maybe they’re not going to make it and you have to move on. I have a good management team around me that think the same way.

The past 18 months have been the hardest of my professional life, but where we sit now is in the best position we’ve ever been as a company because we’ve got a solid company from a corporate and financial standpoint. We’ve taken a lot of the risk out of the company, and we are a very scarce resource in what we do. So we’re on the precipice of something special. The creation of Orient-Express as a true luxury brand is something that will enable us to drive a lot faster than many commentators at the moment are giving us credit for, and that is quite exciting.•