- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

The License to Lead

Editors’ Note

Charles Moore retired in February of 2013 as Executive Director of the Committee Encouraging Corporate Philanthropy following a highly successful 13-year run. He is a 1952 Olympic gold medalist in the 400-meter hurdles, has been CEO of three multinational manufacturing companies, Athletic Director for his alma mater Cornell University, and a member of the President’s Council on Physical Fitness and Sports.

Organization Brief

The Conference Board is building a center of expertise dedicated to supporting CEOs in achieving long-term financial success for their respective corporations. This center, which will launch in 2015 as the Institute for Sustainable Value Creation (isvc.co; ISVC), is focusing on an integrated three-part approach to enduring value creation. A fundamental conviction underlying the creation of this center is that maximizing long-term shareholder value can only be accomplished on a sustainable basis by serving the constituencies that create the value – employees, customers, suppliers, and communities. This requires companies to outperform in three areas: unlocking the value of intangibles, long-term thinking and planning, and fostering high levels of trust in the business. We feel strongly that this emerging research is critical for present and future generations.

What is the immediate goal of the institute?

The immediate goal of the institute is to produce an actionable framework, based on research and input from a wide range of thought leaders that will help CEOs and their boards of directors measure and communicate their value creation strategy to investors and stakeholders. This will entail developing metrics and case studies around the institute’s central themes.

How do you plan to conduct this research?

In addition to drawing on and synthesizing a broad range of work on metrics and practices in the three areas mentioned, we are conducting expert roundtables. Our research and work plan also will include: developing metrics that describe the extent of a company’s long-term thinking and behavior, investment in building trust, and valuation development of intangible assets, while identifying companies that are successful in achieving superior long-term financial performance, and measuring their long-term thinking and behavior, growth in intangible assets and level of trust (using the metrics identified above). We are looking for patterns that identify the relationship between these central themes and behavior, so that companies can adopt these successful approaches, while providing CEOs with a narrative based on the analyses and data above that explains why they are pursuing a sustainable value creation strategy.

What is the most important question the institute seeks to answer for CEOs?

The institute seeks to connect the dots between strong and sustainable financial performance in corporations and strong corporate performance on intangibles, long-term thinking, and trust-building so as to answer the question, “Are there patterns among the leaders that companies can mimic for success?”

Would you expand on what is included in further developing the value intangibles?

An intangible asset is a nonphysical claim to future benefits. Today, 75 to 80 percent of a company’s value is hidden and not included in traditional financial analysis.

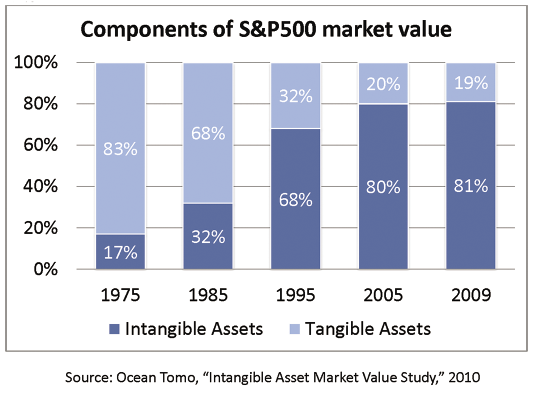

As reported by Baruch Lev (2001) in Intangibles: Measurement, Management, and Reporting from Brookings Institution Press, “Within the last quarter century, the market value of the S&P 500 companies has deviated greatly from their book value. This “value gap” indicates that physical and financial accountable assets reflected on a company’s balance sheet comprise less than 20 percent of the true value of the average firm (see chart).”

We are currently studying a variety of ways to categorize intangible assets. The large accounting firms, investment firms, academic researchers, nonprofit organizations, and even some companies are exploring different frameworks for defining and measuring intangible assets. While progress has been made to value intangibles in macroeconomic measures such as GDP, finding quantifiable, replicable measures across companies and sectors is a challenge. No single framework may be equally relevant or applicable to all organizations. But it’s clear that the long-term viability of a company’s business model – of its ability to create value over time – depends in part on how effectively companies develop and manage their intangible assets. The right metrics can serve as leading indicators for a company’s management quality.

How will this research be funded and organized?

The institute operates as a unit of The Conference Board, a 501(c)(3) organization. The funding for the institute’s research will come from the investment of 25 Leadership Founders, from which a board of directors will be formed to oversee priorities and deliverables of the institute. The Conference Board is uniquely positioned to support the institute because its business practices all relate to the priorities of the institute, as does its research capacity. The Conference Board is also well suited to attract strategic partners who can contribute to and benefit from the research and its outcomes.

Who are the principal benefactors of this initiative and why?

The benefactors are CEOs, their boards of directors, investors, and stakeholders in general. Particularly, the Leadership Founders have the opportunity to shape emerging research and be a part of a call to focus business leadership around central themes of long-term thinking, increasing the value and understanding of intangible assets, and fostering trust in business, while investing in a framework that will help CEOs measure and communicate their value creation strategy.

The institute is predicated on the position that sustainable value creation is an outcome rather than an objective. It is expected to be a marathon rather than a sprint.•