- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

William R. Berkley

A Lasting Legacy

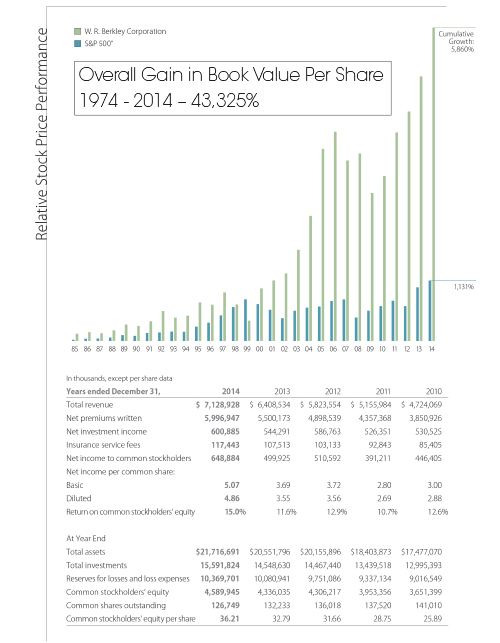

Outstanding Long-Term Performance

Editors’ Note

William Berkley has been with the company for 48 years and is its founder. W. R. Berkley Corporation announced in early August that W. Robert Berkley, Jr., President and Chief Operating Officer and a 17-year veteran of the company, will succeed his father as CEO on October 31, 2015. Bill Berkley will remain Executive Chairman and continue to be fully engaged in the company’s activities, primarily focused on investments and strategy. He has an M.B.A. from the Harvard Graduate School of Business Administration and a B.S. from New York University.

Company Brief

Founded in 1967, W. R. Berkley Corporation (wrberkley.com) is an insurance holding company that is among the largest commercial lines writers in the United States and operates in three segments of the property casualty insurance business, including Insurance-Domestic, Insurance-International, and Reinsurance-Global. Their company could not be a success without the commitment of their more than 7,000 employees. Their competitive advantage lies in their long-term strategy of decentralized operations where each unit can respond to local market conditions and customer needs.

What is the secret to the consistent success of W. R. Berkley Corporation?

We talk to people about risk-adjusted return so it’s not only about making the most money, but making the most money in a consistent way.

This means we don’t focus on what is called PML (probable maximum loss), but instead on what the absolute maximum loss is that we can sustain. We look at worst-case outcomes. We’re always concerned with the outcome that is the unforeseen event, which allows us to avoid the extremes and have more consistent results. We’re not willing to take mediocre returns if the risks of zero or negative returns are substantial.

We focus on the downside as well as the upside. While everyone is always looking at how much money they can make, we’re looking at what are the exposures and risks. We want to be sure we are around to be in the game the next day.

Is that a differentiator that can be well understood? Is there an education around it?

Looking at our results, it becomes clear that during moments when there are industry-wide catastrophic unanticipated losses, we have consistently had a substantially better-than-average performance.

One can look at our outcomes and see that we manage to avoid those unforeseen events. It’s a strategy. It also positions us for the opportunities that are created by the adverse event.

How can you ensure that?

Everyone talks about it, but our financial results over the years demonstrate that we have done it. Our losses in the World Trade Center tragedy were less than $10 million because of what business we wrote, how we bought reinsurance, and what our exposures were.

Many of our policies have aggregate limits of only $1 or $2 million. We pay attention to our aggregate limits, so we can’t lose more than that, even if the worst event occurs.

We’re always concerned with the outcome that

is the unforeseen event, which allows us to

avoid the extremes and have more consistent

results. We’re not willing to take mediocre

returns if the risks of zero or negative

returns are substantial.

Is there significant innovation taking place within the industry and, if so, in which areas?

Insurance is embedded in everything that happens in the real world. Whether it’s Uber cars or shared ownership of bicycles or mopeds, or Airbnb, each one of those new ideas requires insurance. We have to create the way we’re going to insure those who we’re going to protect and identify what we’re going to protect. Each of these issues requires someone to ask what the exposures are, what bad things can happen, and how we protect people and businesses.

Every bit of innovation in the world requires someone in the insurance business to examine what is going on and figure out how to deal with the risks inherent in that activity. It’s a constant issue.

For instance, microbreweries are suddenly producing all of this beer. How do we insure the product liability of a microbrewery? How do we help that microbrewery business protect people from getting sick? How do we take advantage of the huge capital requirements for so many little businesses?

The insurance business looks boring and dull, but that is for people who don’t understand it. There are all of these challenging and interesting things going on that require people to examine the technology, the marketing, and the consumer behavior for all of this new activity in the ever-changing world.

Something like self-driving cars changes the entire automobile insurance industry. Who are we insuring, the car or the non-driver?

There is virtually nothing that is not touched by insurance, but this industry isn’t always looked upon favorably. Why isn’t there a better message out there about the critical role that insurance plays?

It’s probably the most important building block in terms of financial stability in the world because everyone needs insurance of some type or another to be able to enter into business. No bank will lend money to someone without insurance. Companies will not sell new product unless they have product liability insurance.

It’s the essential building block but it is only used when something goes wrong. If someone is driving their new car, they’re generally happy about their purchase, and it’s all great. When one purchases a new insurance product, it’s for when they have negative events such as a crash, a hurricane, or a flood comes, or they get poisoned, or when a building collapses.

People only look to use insurance when something unforeseen or negative happens, so it doesn’t give them a positive view, even though what it does effectively allows them to deal with the adverse consequences of things going wrong.

With so much growth coming about internationally and from emerging markets, do you still see strong growth opportunities within the U.S. or will much of your growth come from overseas?

The U.S. economy will continue to grow and we expect substantial growth in our business in the U.S. Overseas will continue to do well, but much insurance premium comes from liability issues. We have a much more refined tort system, so I would expect much of the growth will still come about in the U.S.

What is your view of the influence proxy advisory firms have on companies’ Say-On-Pay vote?

We have the view that our board and our management operate on the old-fashioned concept of agency. This means that we behave in lieu of the owners of the company in managing the business every day. This is the underlying concept of a board of directors and management.

In the old days, people who owned a business ran it. Governance and boards came about when the owners and management became separate.

These advisory firms says, “Your board and your management are supposed to run the business instead of the owners.” We think we do that really well, and it’s demonstrated by the long-term performance of our company.

Ownership has evolved to where we have index funds that really don’t know the business at all and to where investors who buy the stock and who understand the company are no longer involved in how they vote. Institutions like ISS now set up governance rules that have nothing to do with how well the company does using appropriate measures.

This is a long-term business. We can have an up or down year at any moment in time and it can have nothing to do with how well we wrote the business.

For example, if we look at our performance over one year, five years, seven years, 10 years, 15 years, or 20 years, we were either number one, two, or three out of the whole industry. On three years, we weren’t because our stock didn’t go down as much as our competitors did when the market softened after the financial crisis, so we didn’t bounce up as much.

There are critical elements in our compensation plan that make all the difference in the world for an insurance company. All of the senior officers and directors here have to own stock, everything they were granted, for as long as they work here. They can’t sell. That helps ensure that they’re making good long-term decisions and not playing the cycle.

We think this is the most important element of our compensation plan. We think it trumps everything else. It gets a “Thank You” from the advisory firms. It’s one of the reasons why we have long-term directors. They don’t think it’s good that we have long-term directors, but we think it’s terrific that we have long-term directors who understand our complex business so well.

Our view is that the advisory firms and a lot of other enterprises want to check governance criteria boxes instead of objectively asking how the company is doing, what is going on, and what is important and what is not important.

Focusing on the important things, we do really well and most of our investors believe that also. In the meantime, as the largest shareholder with 22 percent of the company, we’re going to continue to run the business in the way we think is best for all our shareholders – not best for an external governance committee that we might not agree with.

Looking at our results, it becomes

clear that during moments when there are

catastrophic unanticipated losses, we

have consistently had a substantially

better-than-average performance.

When you look at the various constituencies that the company has, do you perceive them equally?

Our primary obligation is to the shareholders of the company, but we also have an obligation to our employees, our customers, and our agents in the communities in which we operate. These other obligations cause us to have a slightly longer-term view. We have to be sure we have good balance and have thought about what is good for the company and that we’re doing the right thing. We’re part of a society that has allowed us to succeed and prosper. We clearly have to do what is in the shareholders’ best interests, but times will arise when the short-term best interest might not be the same as the shareholders’ best interest over the longer term.

With as much capital as is available today, is there enough focus around return on capital for shareholders?

We think that we need to have a certain base level of capital. Twenty years ago, that was $1 billion; today, it’s probably $2.5 or $5 billion.

Once we get past that base level of capital, there is a huge amount of capital available in this industry, but we don’t think getting big just to be big is nearly as important as a number of our competitors seem to think.

There is a lot of capital available and there are also many relationships we create that will provide us with all the capital we want.

The growth of the company speaks for itself, but it still manages to maintain a family culture. How important has it been to keep that culture and how do you define the culture?

The family culture is where people matter. Eight years ago, we put out an annual report with a picture of every single employee – we had about 5,700 employees at that point. We said, “Everything counts, everyone matters.”

We think that’s a really important idea because everyone in the enterprise can make a big difference. Whether it’s being sure something is filed or put in the right place in the system or how the phone is answered and a customer is helped, everyone is a part of what we do and we’re here to serve the customer who only comes to us when they have a need. If we fail them when they have a need, we have let them down.

This is a really important aspect. As a family, we want people to know they can always count on us. This is the expectation we have for everyone here and, hopefully, we have an attitude among all of our employees that we’re supposed to do the right thing. This is a bit different from many other enterprises.

As long as we do the math right and we’re careful, we’ll make money. We can do the right thing and still have a great outcome for our shareholders.

Many companies say that when you get to a certain size and scale, it’s hard to maintain an entrepreneurial spirit and edge. You started this company as an entrepreneur and you still look at it as one. Is it difficult to maintain that entrepreneurial spirit?

It’s a constant battle because, as we hire new people, they come with their own baggage and culture.

We have what we call the Management One training program. I spend six hours with each group that comes through that program to be sure they get a sense of who we are and what we do.

We do our best to get people to understand that everything happens because somebody does something. It’s a hard process. In general, we’re still winning the battle, but it’s one that goes on constantly and it’s one we rely on the people in the field to reinforce every day. It’s not a battle where we declare, “We’re good, we’re brave, we’re wonderful,” and we’re satisfied that we’ve reached our goal. It’s a battle where we say, “We care about our customers, we care about each other, we care about the people who own the business and provide us capital.” We have to do a great job and work at it every day.

Those who know you believe your finger is on the pulse of the business at all times. Are you changing your role and is it hard for you to not get as deeply involved when you know the way you like to see things done?

We all get older, still we think we’re just as good as we were when we were younger. Five years ago, I told my son that at 70, I was going to step down as Chief Executive because I knew if I didn’t at that age, I’d say “Why not 75?” So in October, I’m going to step down as Chief Executive and become Executive Chairman. I don’t think I’m going to do a lot differently than I have been doing. Clearly, I don’t know as many of the details now as I did earlier, but I probably still know more than many people who are running businesses because I care about the details and I talk to people.

I’m also still fully immersed in the investment side of the business and the strategy side of the business, but people have to recognize that reality moves along whether we acknowledge it or not. So I’m less immersed in the details by my own choice. We’re all working together and I think we’re pretty happy about it.

You talked earlier about the exciting and dynamic opportunities this industry offers. What do you tell young people about the opportunities that the insurance industry offers and more specifically, a company like W. R. Berkley?

This is a business that is complicated to enter and that’s why corporate America hasn’t done well in it. It is unlike making widgets, where the most that can be lost when one enters into the business is whatever one invests in the widget. When an insurance policy is written, there isn’t just the amount of the premium that is lost; the amount of policy limit is also lost. So I can collect a $500,000 premium but I can lose hundreds of millions of dollars.

Smart people sometimes feel frustrated because it’s not easy to get into this business. It’s also not easy to get people to take the responsibility they should when they’re young because the leverage is so great. It’s a business where one has to learn the analytics and how they work, as well as to be numerically and analytically inclined. Once it has been figured out, it’s a business with huge potential. It’s a business with an unlimited upside, but one has to invest a few years in figuring out how it works.

You’ve spoken about the opportunities ahead but there have been many wins along the way. For you personally, are there moments during the journey when you take the time to celebrate the wins or are you always thinking about what’s next?

Every entrepreneur always wants to find ways to do things better, faster, and bigger. The list of things I keep is a list of the stupid things I’ve done that have almost been catastrophic failures. It’s a list I keep to make sure I don’t repeat any of them. I’m never worried about celebrating the successes; I’m more worried about trying to avoid the pitfalls.

There is an unlimited number of opportunities and that continues to surprise me. New ideas are out there. We don’t find all of the new ideas and we don’t see all of the opportunities, but we see a lot of them. Success is the celebration you want.

Is an entrepreneurial mind something you’re born with? How much of it can be taught?

Entrepreneurship is a dissatisfaction with the status quo. If one is always unhappy with how things are and knows he can make them better, he’s an entrepreneur. The tipping point occurs when someone is brave enough to step out of that shelter and say, “I’m dissatisfied with how this is. I know I can do this better.” That’s the key.•