- Home

- Media Kit

- MediaJet

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

![]()

ONLINE

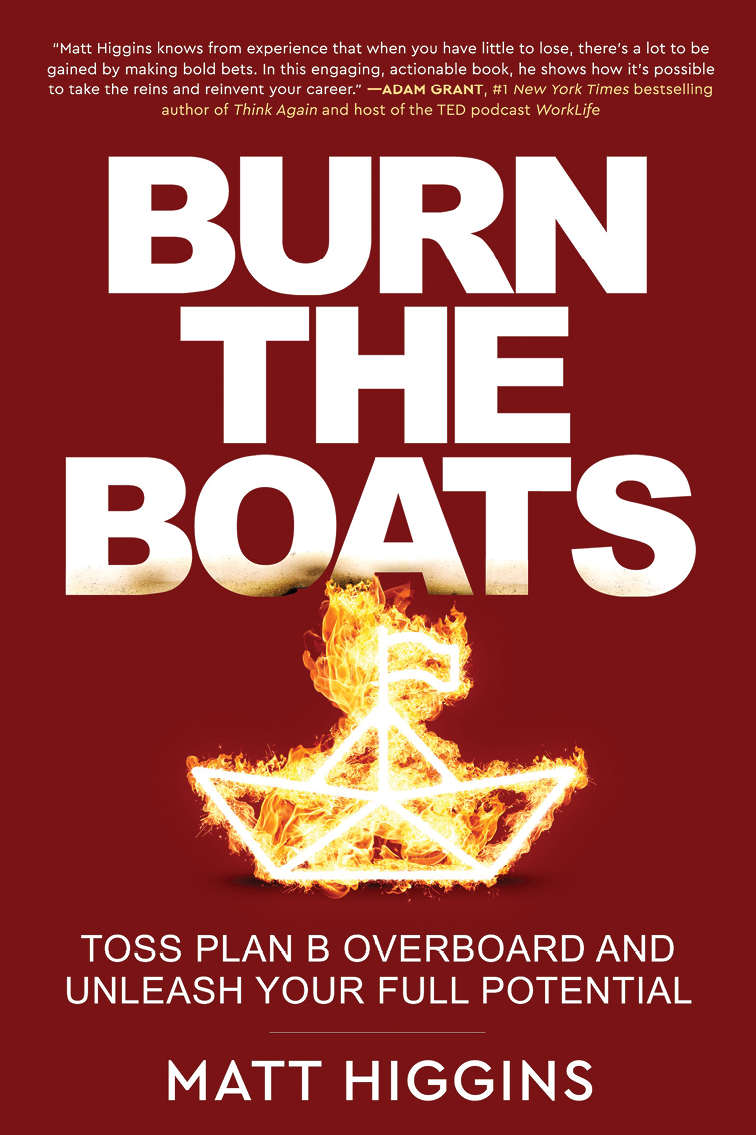

Burn the Boats

Editors’ Note

Matt Higgins serves as Cofounder and CEO of private investment firm, RSE Ventures, and is also an Executive Fellow at the Harvard Business School where he co-teaches the course “Moving Beyond Direct-to-Consumer.” Higgins’ reputation as a self-made serial entrepreneur earned him a spot as a recurring guest shark on ABC’s Shark Tank during seasons 10-11, and he’ll soon star in a new spinoff also produced by Mark Burnett. His deep operating experience spans multiple industries over his 25-year career which he draws upon to help founders navigate complex situations in order to reach their full potential. Higgins previously spent 15 years in senior leadership positions with two National Football League teams: starting as EVP of Business Operations for the New York Jets before serving as Vice Chairman of the Miami Dolphins for nearly a decade. He cofounded NYC-based RSE Ventures in 2012 alongside developer Stephen M. Ross, amassing a multi-billion-dollar investment portfolio of leading brands across sports and entertainment, media and marketing, food and lifestyle, and technology industries; NYC’s iconic Magnolia Bakery is one of the latest additions to a portfolio that includes David Chang’s renowned culinary brand, Momofuku, and Australian-inspired hospitality/lifestyle brand, Bluestone Lane. Higgins was the first client and ultimately only partner in VaynerMedia, the largest social-media first agency in the world founded by Gary Vaynerchuk, and his first book, Burn the Boats, will be published by William Morrow in February 2023.

Firm Brief

RSE (rseventures.com) is a private investment firm that combines a deep understanding of a founder’s mission with the strategic resources of its network to elevate businesses at inflection points. This approach has transformed companies across sectors: RSE has taken the International Champions Cup from an idea in a conference room to a global soccer platform with 140 million viewers; it helped transform a founder’s PowerPoint presentation into the world’s premier drone racing circuit; and has shaped the growth strategy of scalable restaurants that have iconic brands with cult followings.

Did you always know that you had an entrepreneurial spirit and desire to build your own businesses?

Less a desire to build a business and more to build a life of increasing autonomy. Let me give you some context. I grew up in abject poverty and spent all my energy trying to take care of my sick mother. I spent many years as a little boy praying the calvary would come, some white knight, but as we all learn, the calvary never comes. It’s up to you to be an agent in your own rescue, as a wise friend once told me. So I engineered my way out of poverty by making one radical decision. I dropped out of high school at age 16, took my GED, enrolled in college two years earlier than my peers, and got a better paying job that was only available to college students. Everyone said I was crazy, and they were right, but they didn’t have visibility into my desperation. I had to trust my instincts. Just 10 years later, I had graduated from college, law school, and became the youngest press secretary in New York City history. Unfortunately, it all came too late to save my mother. She died the first year on the job as press secretary when I finally had enough money to support her. My lifelong takeaway was that none of us are guaranteed happy endings, and the more autonomy you can achieve, the more you can help yourself and the ones you love the most. That was the spark that launched my career in business.

Do you feel that entrepreneurship can be taught or is it a skill that a person is born with?

It absolutely can be taught and must be taught. Almost everyone has some insight that could be the seed of a business. Whether they wish to pursue it is a personal and lifestyle choice. But there are millions of people who don’t because they have a distorted relationship with risk and think it’s safer to maintain the status quo. That’s one of the core topics I cover in the book – how to cultivate your own risk tolerance so you can go all in on your first choice, Plan A, instead of settling for Plan B.

Will you provide an overview of RSE Ventures and how you define the firm’s mission?

We are a consumer investment firm operating in sports, entertainment, food and beverage, and technology founded by developer and Miami Dolphins owner Stephen Ross and myself. We are a founder-focused firm that specializes in using our collective expertise to unlock potential rather than financial engineering. I believe that the fish rots from the head, a great Italian expression. It just means that most problems in an organization and the upside potential resides at the top, with the leadership, and that’s where we spend all of our time. We own sizable positions in great brands and we roll up our sleeves to tackle the challenges that matter most – scaling, real estate decisions, hiring choices. Our portfolio includes some recognizable names like Milk Bar, Magnolia Bakery, Momofoku, and VaynerMedia, now the largest privately owned ad agency in the world started by Gary Vaynerchuk.

What are the traits you look for when evaluating an investment opportunity?

My first principle is that I don’t want to sign up for a rescue mission. I want my effort to make a difference, not the difference. That’s not an investment – it’s a job.

I look for a large Total Addressable Market (TAM). I also look at the founder/product fit, meaning that I want to feel that the universe put the founder on this earth to pursue this exact business. Solving an unmet need in a very differentiated way, ideally with a customer experience that feels magical, is another principle. And I look for sectors where there are exponential rewards once the innovation achieves escape velocity. In other words, I will only sign up for a long slog provided there is a massive payoff on the other side of the rainbow. If the business doesn’t eventually scale in some asymmetrical way, I run the other direction.

But most importantly, above all else, I evaluate the founder. The biggest mistakes I’ve made in investing happened when I became so enamored with the cleverness of an idea that I overlooked all the warning signs about the founder. Experience has taught me the painful lesson that a great idea will never overcompensate for a weak founder. But the inverse is also true. A great founder will evolve faster than the consequences of their poor decisions and iterate to a better place. The key attribute to identify is self-awareness.

You mentioned your book, Burn The Boats. What are the key messages you wanted to convey in the book?

I love surfacing the uncomfortable missing conversations most people aren’t willing to have, yet should have. That’s where real arbitrage in life exists. In mentoring so many budding entrepreneurs over the years and teaching at Harvard Business School, I kept coming across this one central theme holding most people back: an inverse relationship with risk. We are programmed to think the status quo is safe, and that we should defer to experts instead of trusting our instincts. I want to help people recapture their personal power by writing a blueprint for going all in on Plan A. I studied the science, psychology and history around the idea of Burn the Boats – eliminating your escape route to unleash your best effort – and what bears out since the beginning of time is that humans perform better when they have no choice.

I dissect the common internal and external obstacles that impede risk taking – imposter syndrome, shame, corporate saboteurs, for example – and provide an actional guide to surmount them. I felt there wasn’t a book on the marketplace that actually illustrates how to maintain a growth mindset, rather than just advocating for one. I don’t just use elements of my story, but 50 different founders, billionaires, activists, athletes and activists I interviewed – everyone from Marc Lore to Scarlett Johansson – to show how they all had to cross the threshold to total commitment, and just how uncomfortable that journey is for everyone, no matter how rich or famous or gifted you are.

Why does any of it matter? Talk to any marathon runner a few days after they’ve recovered, and they will tell you, finishing the race was a letdown and they miss the training. They miss the work. We humans are not meant to actually finish anything – we are destined to remain works in progress trying to find the ceiling of our own potential.

The joy of living is in the striving. That’s the point of my book.

Who is the book targeted to when you look at its messaging and advice?

I think it applies to anyone with unsatisfied ambition who is just tired of hesitating and hedging. Someone who feels a bit stuck and can’t quite figure out how to surrender to the goal. I especially want to reach marginalized members of our society who have been conditioned that success must move along some steady preordained progression, or that the rules are stacked against them. Corporations and society promote incrementalism because it’s an efficient way to organize humans. Do this job for five years and then you will get a promotion. But I think waiting for your turn is for kids. It squanders so much potential. I want people who read this book to stop dwelling on “what if,” and start demanding, “what’s next.”

What do you feel are the keys to effective leadership?

Self-awareness is right at the top because it scales well. If a leader is self-aware, they will make their own course corrections. They don’t need an intervention from the Board, the management team, or a spouse. They remain intellectually curious about their own decision-making and under-index on defensiveness so they remain open to the idea they are simply wrong. Empathy is a close corollary because, aside from being the decent thing to do, empathetic leaders have a 360-degree perspective on situations. They are able to step into someone else’s shoes. They have a wider aperture and take in more information, which just improves their decision-making.

How do you describe your management style?

That’s probably best for someone else to say. What I aspire to be is demanding but inspiring and modeling high expectations through the pressure I put on myself. I spend a lot of time trying to figure out someone’s superpower and how to put them in a position to best use their gifts. I’m sure being around me can be maddening since I am not someone who embraces routine. I cherish my spontaneous insights and I don’t want routine to inhibit my time to mentally roam, and that’s probably a bit unsettling for anyone in my glide path since I am highly unpredictable – by design.

With the success that you have achieved in your career, do you enjoy the process and are you able to take moments to celebrate the wins?

Unfortunately, I really don’t take time to celebrate the wins and I don’t think that’s something to be proud of. It’s probably a symptom of some still unresolved defense mechanism. What’s the point of it all if you don’t experience the joy? But I am wired to love the pursuit. I always say, opportunity arrives before the tipping point of evidence. I am happiest when I identify a trend on the far distant horizon and have the courage of my conviction to go all in when no one else agrees. When it does play out as I expected, it fills me with awe that the universe is in fact knowable, that there are subterranean patterns you can discern if you pay close enough attention.

And then I move on to the next thing.![]()