- Home

- Media Kit

- MediaJet

- Current Issue

- Past Issues

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

- PRIVACY POLICY

- TERMS OF USE

![]()

ONLINE

![]()

ONLINE

Trust, Transparency,

And Collaboration

Editors’ Note

Gillian Murray is Chief Risk Officer & Treasurer for Rockefeller Group. In this role, she is responsible for treasury operations, debt capital market activity, and investment risk management. She also leads the Treasury Department, including cash management, cash forecasting, and short-term investments. Murray is a highly experienced real estate finance executive with domestic and international experience. Since joining Rockefeller Group, she has helped the company expand its access to capital through new banking and finance relationships in support of the company’s rapidly growing U.S. development platform. She spent much of her career with HSBC Bank, most recently as Senior Vice President and Team Lead, overseeing HSBC’s New York City originations team. Throughout her career, she has closed more than $3 billion in balance sheet loans spanning various transaction types including industrial, hospitality, multifamily, retail, biomed/life sciences, and student housing. From 2015-2017 she was based in Bermuda, where she managed the HSBC Bermuda and HSBC Cayman Islands commercial real estate portfolio. Murray earned her bachelor’s degree from Elon University and her master’s degree from New York University.

Company Brief

Rockefeller Group (rockefellergroup.com) develops, owns, and operates extraordinary properties across the United States. For nearly a century, the company has delivered exceptional experiences and value creation through dedication to quality in the built environment. The company’s portfolio spans the development of industrial, office, multifamily, and mixed-use projects across seven geographic regions and about six million square feet of world-class office space in Manhattan.

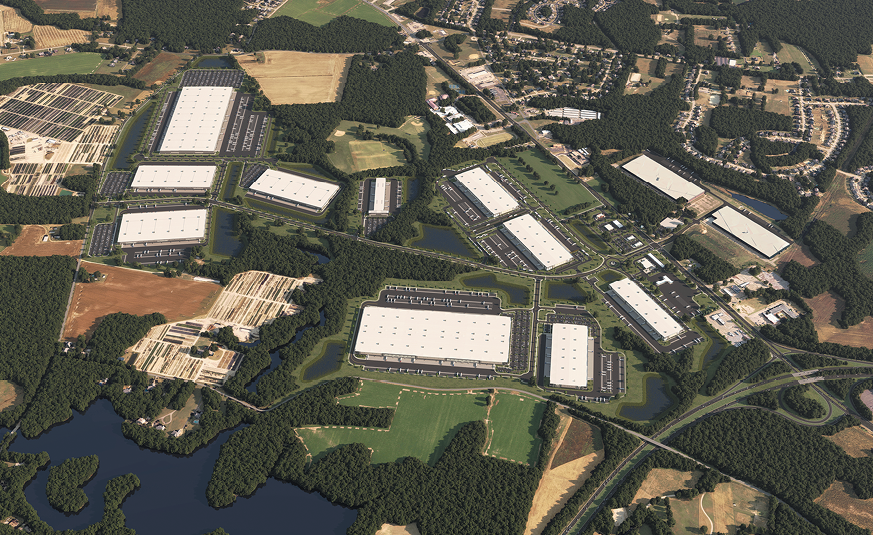

Rockefeller Group, in partnership with the Matan Companies,

started construction in 2024 on Port 460 Logistics Center, a massive

5-million-square-foot industrial development project on

500 acres near the Port of Virginia

What excited you about the opportunity to join Rockefeller Group and made you feel it was the right fit?

After 16 years in banking, I felt ready to take the next step in my career by transitioning to the other side of the table – development. I was focused on finding a collaborative culture, surrounding myself with bright people who take pride in what they do, and finding new challenges and opportunities. In 2022, I joined Rockefeller Group where I’ve had the privilege of working alongside intelligent, talented, and dynamic colleagues with a growth mindset.

Watching a project evolve from a conceptual idea to a tangible, functioning space that enhances the community is incredibly rewarding. The ability to shape environments and leave a legacy through development makes a career at Rockefeller Group both exciting and impactful. The role has pushed me beyond my own expectations – it has proven to be the right fit.

How do you describe Rockefeller Group’s culture and values?

We foster a collaborative, inclusive culture built on core values such as teamwork, integrity, excellence, and a passion for driving positive change. Every property we develop, own, or manage is focused on quality, with the goal of improving neighborhoods, cities, and people’s lives. Rockefeller Group has earned a reputation in the lending world as a developer committed to doing the right thing, and there’s a sense of pride and purpose in working for a company with those principles.

“Rockefeller Group remains agile and proactive in navigating today’s challenging capital markets, focusing on finding optimal financing solutions to support our growth goals.”

Will you provide an overview of your role and areas of focus?

As Chief Risk Officer and Treasurer, I lead the Treasury team in supporting the company’s financial health and growth. Our team manages cash, debt, investments, and risks while maintaining bank relationships, monitoring cash flows, optimizing liquidity, and ensuring that the company has sufficient funds to meet our financial obligations.

A key part of my role involves fostering strong relationships with financial partners and securing financing for real estate projects. I also participate in our investment committee process, evaluating the feasibility and risks associated with each development opportunity. Additionally, our team collaborates closely with the regional development team and legal teams to align efforts and ensure smooth execution of investment strategies and transactions.

How valuable is your banking experience and expertise in your role at Rockefeller Group?

My banking experience has been incredibly valuable in my current role as Chief Risk Officer and Treasurer. Having spent 16 years on the other side of the table originating real estate loans through numerous cycles, I understand how lenders think which helps me anticipate their concerns, explore creative financing structures, and identify areas for negotiation. I have always viewed the lender-borrower relationship as a partnership, not just a transaction. This mindset carries over into my current role, where I focus on building strong, collaborative relationships with our financial partners. Communication and trust are key, and my background has given me a deep appreciation for their importance.

Additionally, my experience has provided me with a strong network of lender contacts, which is a great asset. Having spent years structuring deals, the process feels natural, and I enjoy working closely with lenders to bring projects to life. Ultimately, it’s about working together to build something impactful.

Rockefeller Group recently completed Patten Gray,

its first luxury rental project in downtown Denver.

The 250-unit project, located in Denver’s Golden Triangle

neighborhood, prioritizes ample living space and amenities,

and boasts 360-degree views of the Rocky Mountains

Will you discuss Rockefeller Group’s efforts to expand its capital partnerships as part of its growth strategy?

Rockefeller Group remains agile and proactive in navigating today’s challenging capital markets, focusing on finding optimal financing solutions to support our growth goals. Building and maintaining strong relationships with lenders is crucial to us to ensure continued access to capital for our projects. As we develop into new markets and asset types, we continue to build and broaden our lender relationships.

While the environment over the past 18 months presented challenges, it also created opportunities for creativity and innovation. In 2024, we added two new team members to our treasury team, strengthening our ability to support Rockefeller Group’s growth and strategic decision-making.

Our strong reputation and track record make us a preferred borrower, and we prioritize long-term partnerships built on trust, transparency, and collaboration. Our strong relationships with lenders and investors combined with diverse financing sources provide flexibility and resilience. We greatly value our capital partners who have navigated the challenging capital markets environment alongside us, employing creative solutions and showing commitment to the success of our projects.

Will you highlight Rockefeller Group’s current development projects and strong development pipeline?

Rockefeller Group has experienced tremendous growth and geographic expansion in our development business over the past five years. In that time, our project pipeline has more than doubled and our active projects today are valued at over $6.1 billion. We recently expanded our footprint by opening two new offices: one in the Southwest region, focused on the Dallas-Fort Worth and Houston markets, and another in Seattle. Our Southwest team has grown to nine members, and both regions have a robust pipeline of industrial and multifamily projects slated for 2025.

Additionally, our NJ/PA region has expanded to the Midwest, now operating as the North Central Region. These strategic expansions align with Rockefeller Group’s long-term growth objectives and position us for continued success.

Do you feel that there are strong opportunities for women in leadership roles in the industry?

I do, especially at Rockefeller Group where I am proud to see so many experienced, influential women in leadership roles. This reflects the company’s commitment to fostering an open, inclusive culture that values diverse perspectives and ideas.

Throughout my career, I have been fortunate to have mentors who regardless of my gender, recognized my potential, often before I fully saw it in myself, and opened doors based on my abilities. Mentorship has played such a pivotal role in my own professional development. That’s why I am committed to supporting the next generation of women leaders. The industry thrives on collaboration, communication, and problem-solving – skills that many women excel at. There is no role in real estate that women aren’t capable of mastering, and I want to ensure they know I am a trusted resource offering advice and guidance as they navigate their careers.

What advice do you offer to young people beginning their careers?

Early in your career, there’s often pressure to lock down a career path, but this is the best time to be bold. Ask yourself what you would do if failure wasn’t an option and go for it. Motivation follows action – just take the first step. Surround yourself with good people; no one succeeds alone. Taking the initiative to handle a task, whether big or small, and delivering it efficiently and effectively is one of the best ways to stand out. You’ll achieve more by being consistently reliable than by being occasionally extraordinary. Be true to yourself. Define your own version of success – it doesn’t have to follow the norm. And if you’re unsure what to pursue or doubting yourself, focus on becoming the healthiest, happiest, and most confident version of yourself – the right path will reveal itself.![]()